Kuwait-based Boubyan Bank recently announced a fully licensed and regulated digital Islamic bank in the UK, media reports said. Branded as Nomo, the bank will cater to customers globally.

Nomo has launched as a brand name of the UK-based Bank of London and the Middle East (BLME) where Boubyan is a major shareholder. Other than catering to global customers, the app will also provide a mobile-first experience for affluent, tech-savvy customers.

The digital bank has been developed to accommodate a growing segment of individuals in the Middle East that meet international banking needs. Nomo also provides a digital solution that helps access, move, and invest money in the UK with assurance and ease.

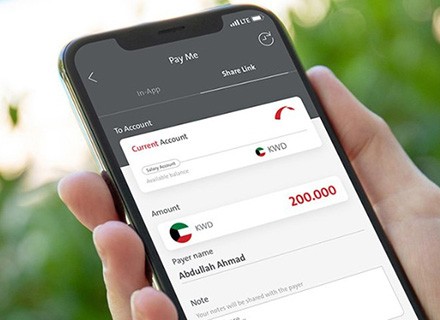

Kuwait-based eligible customers will be able to open their new bank accounts in just a manner of minutes through the Nomo iPhone app and can make international payments in sterling and US dollars. They can also make transactions with a virtual MasterCard debit card. Along with daily banking needs, Nomo also provides Sharia-compliant investment opportunities and fixed-term deposits.

Boubyan Bank Group CEO and BLME chairman, Adel Al-Majed told the media, “Most Islamic banks across the wider GCC region are behind the global digital curve in terms of the digital products and services being offered to customers. Nomo aims to propel Islamic digital banking towards a more innovative future where customer convenience is a priority on an international scale.

“To achieve this, we’ve put together a carefully selected team of global digital banking and payments experts to help us create the future of Islamic international digital banking.”

Nomo is a trading name of BLME and it is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Image credits- Finextra