Investors are losing confidence in Canada’s oil and gas sector owing to a federal government that appears to be hostile to the country’s hydrocarbons sector. Regulatory uncertainty in the sector is resulting in a loss of employment opportunities and investments worth billions of dollars. So until Canada resolves those challenges related to regulatory uncertainty and market access, the sector will continue to spiral downward, the Canadian oil and gas industry warned.

The Petroleum Services Association of Canada (PSAC) in its Midyear Update to the 2019 Canadian Oilfield Services Activity Forecast for the second time reduced its forecast for the number of wells drilled to 5,300 across Canada this year. The figures suggest that there was a 20 percent decline or 1,300 wells lesser from the original forecast of 6,600 wells in November last year. PSAC has developed its updated forecast on the basis of an average natural gas price of C$1.65/mcf (AECO), crude oil price of US$57.00/barrel (WTI), and a US-Canada exchange rate at an average of $0.75.

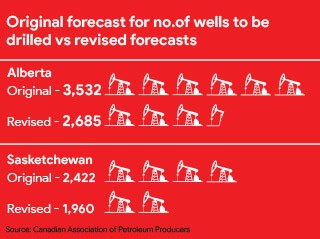

The concerns of the industry are quite justified. On a provincial basis, PSAC is planning to drill 2,685 wells in Alberta, which is reduced from 3,532 wells in the original forecast. The estimated number of wells in Canada’s westernmost province British Columbia’s have also fallen to 375 from an earlier estimated count of 382.

For Saskatchewan, the revised count stands at 1,960 wells compared to 2,422 wells in the original forecast. In addition, Manitoba is expected to have 260 wells drilled, indicating a jump of 5 wells this year. Also, Eastern Canada’s well count has been increased from 9 to 20 between forecast versions—suggesting a bright spot for boosted activity in the country.

For Saskatchewan, the revised count stands at 1,960 wells compared to 2,422 wells in the original forecast. In addition, Manitoba is expected to have 260 wells drilled, indicating a jump of 5 wells this year. Also, Eastern Canada’s well count has been increased from 9 to 20 between forecast versions—suggesting a bright spot for boosted activity in the country.

That said, PSAC is also forecasting activity this year which is much more than plain drilling in an effort to include maintenance work and site closure.

In a recent report 2019 Crude Oil Forecast, Markets and Transportation published by the Canadian Association of Petroleum Producers (CAPP), Canada’s oil sector is being deprived of an important opportunity where it can benefit from the global commodity price and get a reasonable market value for Canadian resources.

CAPP in the report estimated that the country’s crude oil production will continue to grow until 2025, however. The growth pace will be much slower than previously anticipated. It predicts the Canadian oil production to grow at a rate of 1.44 percent by 2035, which measures less than half of the industry’s estimate in its 2014 outlook. It was during that period when oil prices rose above $100 a barrel, renewing hope that new pipeline projects might be under way by 2019.

However, the forecast has turned out to be very different from what Canada’s oil industry had anticipated five years ago. The country is still witnessing a significant pipeline infrastructure deficit and major setbacks in projects. For example, a few takeaway capacity projects were cancelled over these years coupled with persistent sector issues such as regulatory uncertainty and delay in Canada’s pipeline capacity as well as access to new markets.

Last year, the country was put in a difficult spot where it had to sell off its oil at a significant discount. With that, Canadian producers were set back by nearly $20 billion in lost profits, observed Canadian public policy think tank the Fraser Institute. However, the Albertan government took the necessary measures such as imposing temporary caps on production to ease the loss.

There is only a slim chance for Canada to achieve sector competitiveness as oil production is exceeding the pipeline capacity. Also, CAPP in its 2019 report said that the country’s scope for taking advantage of the expected growth in global oil demand in emerging Asian markets is limited.

According to CAPP, Canada’s total oil production is expected to grow by 1.27 million barrels per day to 5.86 million barrels per day from now to 2025. Last year, the country’s oil production stood at 4.95 million barrels per day.

This estimation is less than half the estimated figure that CAPP made in 2014, representing measly 1.44 percent annual increase in growth rate. CAPP in its 2019 forecast said, “This year’s constrained production outlook is due to inefficient and duplicative regulations, reduced investor and producer confidence, and uncertainty around additional transportation capacity.” The noted constraints and uncertainties “are having and will continue to have negative impacts throughout Canada’s economy—from diminishing investment to loss of employment and reduced government tax and royalty revenues,” it said.

Also, Canada’s capital investments in oil and gas sector is predicted to decline to $27.6 billion this year compared to the 2014 forecast of $60.4 billion.

It seems that investor confidence in the country’s oil and gas sector is majorly affected. To make things worse, CAPP and industry experts said that there will be no new pipelines built in the country under the federal government’s Bill C-69.

Between May and April this year, 3,000 workers in Alberta’s oil and gas sector lost or left their jobs. Alberta’s economy is experiencing a lull as oil and gas jobs drop, with a noticeable shift toward healthcare and education employment.

Bill C-69 is stalling the review of major oil and gas projects in the country, including pipelines. However, the Trudeau government in its defence said that it only plans to take responsible initiatives to develop resources, while many believe that the outcome of such changes will prevent new projects from progressing in the sector.

This in fact has encouraged several energy companies to seek opportunities outside Canada. CAPP in its 2019 report said that capital investments in Canada are expected to reach $39 billion this year, compared to $81 billion in 2014. This significant difference in spending was evidently shown in markets where the Canadian oil and gas stocks stood at a 52-week low by mid-June.

For example, energy company Japan Canada Oil Sands (JCOS) has invested $2 billion in projects near McMurray. The company is looking to expand its existing projects. Its major owner is JAPEX with a 94 percent share.

JCOS President Satoshi Abe said that the company has various options to explore considering that it is headquartered in Japan.

Forced discounting

Canada will be forced to sell oil at unreasonable discounts as persistent sector issues have crippled its chances to reach global energy markets. All in all, the sector challenges come back to the country’s pipeline issues, Abe said.

The Senate passed two disputable natural resource bills on June 21, following which another bill was passed. The third bill in fact strengthened a ban on offshore oil drilling in the Canadian Arctic, curbing the possibility of future oil and gas development in the region.

Bill C-48 which would legally put an embargo on oil tankers in northern British Columbia is expected to receive royal assent after it was accepted at third reading in the Senate. That said, Bill C-69 also passed at third reading, and it would overhaul the environmental review process for major projects.

Both bills are largely perceived as measures to provide balance and stability to the Liberal government’s decision to approve the Trans Mountain expansion pipeline, which is part of Prime Minister Justin Trudeau’s efforts to focus on environmental and economic development.

Bill C-69, which most oil and gas lobby groups believe will stop the development of major new infrastructure projects in the country has been examined over several months. Significant export projects such as Trans Mountain, Keystone XL and Line 3 have faced defeat in recent years, which in turn has hurt investor confidence in the sector. Overall, experts believe that it has also affected the Canadian economy.

Even Bill C-48 which puts a ban on oil tankers in northern British Columbia was also believed to stop developments in Canada’s oil and gas sector.

The federal Environment Minister rejected nearly 80 amendments designed to boost investor confidence mainly because the minister’s duty involves protecting Canadians from the oil and gas sector which is known to negatively affect the environment. However, these amendments if passed would have injected tens of billions of dollars into Canada’s economy.

The reason investors are losing confidence in the sector is because energy companies are required to spend nearly $1 billion to get approval on a new pipeline, in addition to the line costs ranging between $6 billion and $15 billion. And with regulatory policies hostile to the sector’s development, there is very little scope for investor interest.

Canada needs pipeline capacity and more efficient regulatory policies to scale up investment opportunities in the oil and gas sector. In this regard, major Canadian producer Suncor Energy’s President and CEO Mark Little said in comments directed to International Finance, “We believe that for investment to return to the province, we must find a path forward for Albertans to get fair value for all of the production in the province. And to that end, we’ll be working with the new Alberta government and the industry to achieve this goal of getting 100 percent of Alberta’s crude oil production to market so that we can receive a fair global price.” Until the federal government changes its stance there is probably no respite for the falling investor confidence in Canada’s oil and gas sector.