The S&P rose by 1.2 percent to 1,725.48 at 4:02 P.M in New York, the yield on the 10 year Treasury note dropped 15 basis points to 2.70 percent.

20th September 2013

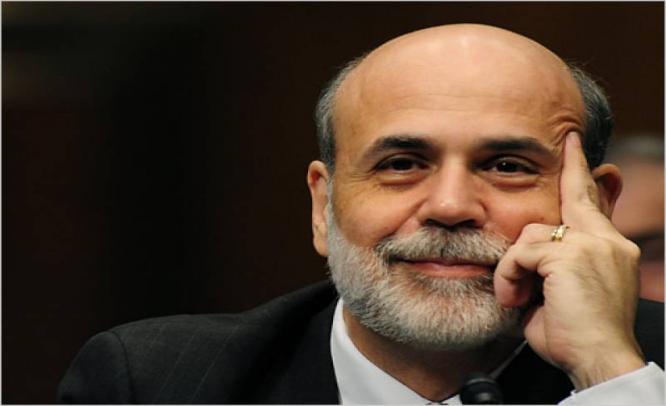

In an unexpected move The Federal Reserve refrained from reducing its $ 85 billion bond buying, saying it needs more evidence of lasting improvement in the economy and warning that an increase in interest rates could curb expansion and growth in the economy. It was widely expected by economists and media that the Fed would start “tapering” its bond buying mainly due to lower inflation and unemployment. The announcement by Federal Chairman Ben Bernanke that Fed will continue with its $ 85 billion a month bond buying had immediate repercussions as the U.S. Stocks rose to a new high, treasuries and gold rallied as Bernanke stressed that the pace of bond buying would be dependent on economic data. The S&P rose by 1.2 percent to 1,725.48 at 4:02 P.M in New York, the yield on the 10 year Treasury note dropped 15 basis points to 2.70 percent. Oil rose by more than 2.5 percent.

Now, the most important question is why outgoing Fed Chairman Bernanke decided against to “taper” its Q.E? – Bernanke has clearly said that the Central Bank will not taper Q.E-3, until the jobless rate is below 6.5 percent; the Central Bank has also said that the target interest rate will remain near zero “as long as” unemployment exceeds 6.5 percent and the outlook for inflation is not higher than 2.5 percent. The Fed has also cited rising mortgage rates and blamed Washington where Congress is heading towards another show down on the debt ceiling by Fed.

Bernanke further emphasized that even after asset purchases are wound down, “The Fed’s rate guidance and its ongoing holdings of securities will ensure that monetary policy remains highly accommodative, consistent with an aggressive pursuit of our mandated objectives of maximum employment and price stability.”

Growth Forecast Reduced

Fed officials also reduced their forecasts for economic growth for the current and next year, they forecast U.S. GDP to increase 2 percent to 2.3 percent this year, down from a June projection of 2.3 percent to 2.6 percent growth.

Sceptical Move?

Some analysts have confounded the theory of the Fed to continue its “easy money policy” – “It’s incredibly wimpy”, said David Kelly, chief global strategist at J.P. Morgan Funds. “We have the strongest automobile sales since 2008, strongest housing sales since 2009. There is a cost to keep this easy money going.” Kelly said it was unclear what kind of economy the Fed would need to see before slowing and would regret later that it did not act quickly to counter high inflation”.

The Fed has kept interest rates at near zero since December 2008 and has undertaken three rounds of Q.E that has increased to a record of $ 3.66 trillion; it currently buys $ 40 billion a month in mortgaged debt and $ 45 billion of Treasuries.

Our view

The Fed has cited a weak labour market and inflation as the reasons to continue Q.E -3, however, an inflated balance sheet could lead to a loss of credibility of the Fed as people will start worry about how to unwind its balance sheet and move all those treasuries and mortgages off its books. The Fed has committed two mistakes in its “exit strategy” they started too late, letting some imbalances build up too much and then increasing the interest rates to stop inflation reaching its peak, and reducing growth in the process. The banks have utilized only half of the money received from the Fed and keeping the rest in their reserves and reducing the chances of high inflation, but once inflation picks up it would be hard to contain it. Considering the fact that Q.E tapering would have its repercussions on financial markets and the emerging economies it would be more sensible that the FOMC when it next meets would decide on a safe exit strategy that would be in the interest of financial markets, emerging economies and the U.S. economy.