According to Global Data’s Wealth in Australia: HNW Investors 2018 report, strong demand for tax advice in Australia can be attributed to the ever-increasing complexity of the global tax system. In addition, local market factors play a role too. Data leaks such as the Panama Papers, which are becoming a common feature of offshore banking, have prompted the ATO to announce probes. In the Panama Papers breach, 1,400 Australians were cited with roughly 570 requiring additional investigation. Subsequently, in 2017 the ATO announced that hundreds of HNW individuals would be subjected to stringent checks.

Heike van den Hoevel, senior wealth management analyst at GlobalData, says, “Traditionally, the ATO has relied on audit and review activity to uncover potential irregularities. However, Will Day, the agency’s new deputy commissioner of private groups and high-wealth individuals, has been conducting one-on-one interviews with representatives of Australia’s richest, making tax more of a focal point and bringing it to the forefront of investors’ minds.”

By the end of 2017, the ATO had already conducted 320 interviews, targeting those with among more than US$268mn in turnover or more than US$383mn in net assets. According to the ATO’s latest annual report, 77 cases with HNW individuals were settled in 2016.

This number is likely to be higher in 2018, as greater emphasis is now placed on large and unusual transactions, the misuse of trusts, and lifestyles that do not match after-tax income. A further 1,200 interviews with individuals in lower asset bands are planned during the course of 2018.

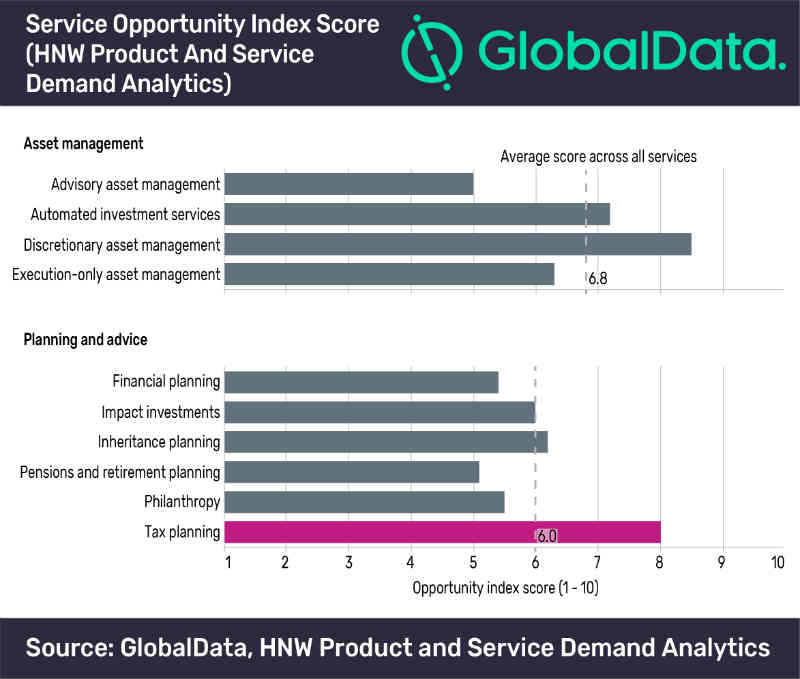

Van den Hoevel concludes: “Out of the two thirds of wealth managers surveyed by GlobalData that do not offer tax advice, less than 5% indicated that they are planning to offer this type of service over the coming two years. This is a lost opportunity, and wealth managers that lack the resources or in-house expertise will do well to consider partnerships with accountancy firms.”