Riyadh-based Alistithmar for Financial Securities and Brokerage Company (Alistithmar Capital) is a major player in the financial services industry. The company offers a wide range of products and services like asset management, brokerage and investment banking. Over the past couple of years, the company has achieved significant growth in AUM with broadened product and services offering and delivering superior performance.

Superior Performance

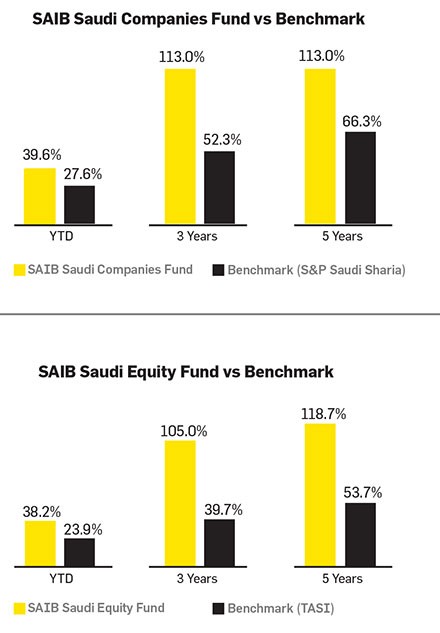

In terms of performance, Alistithmar Capital’s public equity funds have significantly outperformed their respective benchmarks in 2021 on a year to date basis. This was a repeat of the stellar performance of these funds in 2020 and 2019. This success was a result of leveraging the company’s research capabilities, fund managers experience, advanced infrastructure, and dynamic investment philosophy. In fact, Alistithmar Capital’s public equity funds demonstrated their superior performance against their respective benchmark not only on an annual basis but also over longer time horizons. In the 3 years and 5 years categories, these funds continued to produce significant excess returns over respective benchmarks.

The funds’ performances not only stood out against the respective benchmark but also against their respective peers. Alistithmar Capital’s flagship funds SAIB Saudi Equity Fund and SAIB Saudi Company Fund ranked in the top quartile against their respective peers in 2021 on year to date basis, which was also witnessed in 2020 and 2019. Similarly, these funds at the end for the periods in question also ranked in the top quartile against peers in the three years and five years categories respectively. This showcases the investment team’s adaptive decision making and consistent selection capabilities.

Increasing Business

On the business size aspect, Alistithmar Capital experienced significant growth in the value of the assets they manage. By the end of September 2021, the company’s AUM increased to SR32 billion ($9 billion) from SR5 billion ($1 billion) at the end of 2017. Alistithmar Capital’s AUM increase in the reference period is +515 percent which notably outpaced the industry’s AUM increase of +89 percent during the same period. Additionally, the company’s ranking has improved from being ranked number 13th by the end of 2017 to being ranked 6th by the end of Q3 2021 in terms of AUM. This was also seen in the Alistithmar Capital’s AUM share of total AUM where it has increased to 4.3 percent from 1.3 percent for the same period. This increase in value and share reflects investors’ appreciation of the company’s superior performance and outstanding customer service.

Regarding the real estate unit of the firm, Alistithmar Capital has also successfully launched a series of private real estate funds, all of which offered its investors a unique opportunity to participate in prime real estate investments in Saudi Arabia. The latest real estate fund launched was Kaden Alistithmar Fund with a size of SR2 billion, which invested in high-quality income-generating real estate assets. The fund was fully subscribed before the end of the subscription period reflecting investors’ confidence in the company.

Regarding the real estate unit of the firm, Alistithmar Capital has also successfully launched a series of private real estate funds, all of which offered its investors a unique opportunity to participate in prime real estate investments in Saudi Arabia. The latest real estate fund launched was Kaden Alistithmar Fund with a size of SR2 billion, which invested in high-quality income-generating real estate assets. The fund was fully subscribed before the end of the subscription period reflecting investors’ confidence in the company.

The Saudi government launched the Financial Sector Development Program in 2017 that aims to develop the financial sector. In relation to the asset management industry specifically, the program set a number goals such as increasing the value of managed assets, attracting foreign investors, and increasing investment products, which Alistithmar Capital was able to build a strategy to benefit from these goals as displayed by a surge in AUM and product offering.

Outstanding Service

In terms of the Alistithmar Capital brokerage unit, the company was able to successfully execute clients’ transactions of over SR70 billion annually from the period 2017 – year-to-date 2021. In addition, the firm was able to maintain its leading position in a growing market. The Saudi equity market traded value registered an increase of around 148 percent during the period. Despite this remarkable increase in value traded, the firm sustained its ranking in the top ten in each of the years for the period in question.

It is important to acknowledge the changes taking place in the brokerage industry. The Saudi market has hit an important milestone when it was included in a number of global equity indices (the MSCI Emerging Markets Index, FTSE Russell Emerging Markets, S&P Dow Jones Emerging Market Indices) during the period. This development resulted in an increased number of foreign investors and a significant increase in trading activities. Nevertheless, Alistithmar Capital has built up its capabilities throughout the years to benefit from such a trend as evidenced by the successful handling of the annual transaction value and maintaining a leading position in the industry.

The future direction

The Saudi Arabian Capital Market Authority, the Saudi financial markets regulator, announced their strategic plan for 2021–23 where they aim to further develop the Saudi market and make it an attractive place for local and foreign investments. The main pillars of this strategy are to facilitate funding, encourage investment, promote confidence and build capacity. The plan offers many exciting details such as increasing the AUMs as a percentage of GDP from 17 percent in 2019 to 27 percent in 2023, as well as increasing the number of listings annually. Alistithmar Capital aims to leverage its expertise to develop its own strategies based on these governmental strategic plans so that it can not only benefit but also respond more effectively to any future changes in the Saudi financial markets landscape. The company will continue to invest in people, processes, and systems to cater to an even wider range of clientele. It is Alistithmar Capital’s continuing mission to create value for its investors by delivering outstanding performance, increasing the value of assets under management, sustaining a leading position in brokerage, increasing product offerings and refining the overall customer experience. Meeting the expectation of current customers has always been a priority and in order to continue serving effectively, as well as attracting new clients, Alistithmar Capital will leverage its current technological capabilities, adopting new technology where necessary, to refine and expand its reach. The company is looking forward to exploring future opportunities in the Saudi Arabian financial markets.