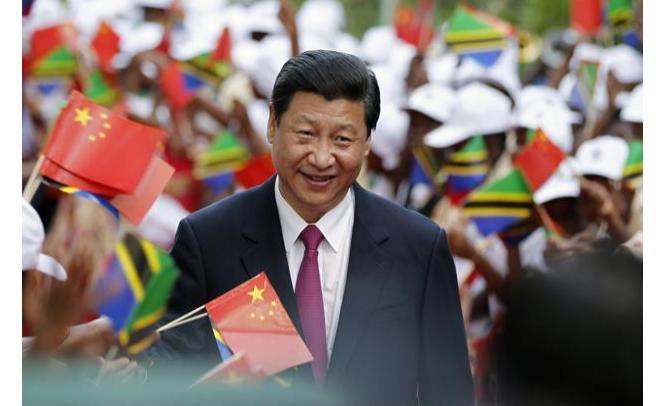

The Leaders of China have indicated their intentions to focus on the quality, efficiency and sustainability of growth. This Signals their willingness to reform.

The Chinese People’s Political Consultative Conference and the National People’s Congress are holding their annual sessions against the backdrop of a once-in-a-decade leadership transition. The new leaders face high expectations. Addressing the country’s glaring income disparities tops the wishlist of many Chinese. The recent release of the guidelines to reform income distribution is a welcome measure. The international community, again, is looking to the new leadership for comprehensive economic reforms that will ensure sustainable growth and help stabilize the global economy.

The open style adopted by the new leaders signals their willingness to reform. They have indicated their intention to focus on the quality, efficiency and sustainability of growth. This will help rebalance the economy and reduce the gap between the rich and the poor. The leaders have also identified reform priorities. Interest rate liberalization, fiscal reform and greater private sector participation are high on the agenda.

So far the leadership has focused on economic restructuring. Several further challenges need to be addressed. Chief among them is the socio-economic impact of a rapidly aging population.

The fiscal constraints related to aging are well known, caused mainly by spiraling healthcare and pension costs. However, the repercussions are much wider. In an aging society, labor markets, saving patterns and migration flows will change. Most worryingly, labor shortages, declining labor market flexibility and slowing productivity pose a serious threat to growth.

In the past three decades, a dramatic increase in life expectancy underpinned by the strict family planning policy prompted the greatest demographic transition in the world. During three decades of economic expansion, China’s growing workforce added a “demographic dividend” of about 2 percent a year to GDP.

With rapid aging, the situation has now reversed. The demographic dividend is vanishing, while the dependency ratio of children and elderly on the working age population is increasing. The labor force shrank for the first time in 2012. By 2050, about 30 percent of the population will be above 60, against a world average of 22 percent.

Aging in China is particularly complex because it is happening at a low-income level. Social safety nets are weak, with most of the elderly depending on family support. Declining family size and the erosion of traditional values magnify the challenge and place a heavy burden on small households.

High-income countries have offset the losses caused by a declining workforce by adopting innovation-driven growth models. China could achieve the same by decisively rebalancing the economy, shifting to consumption-led growth and developing the services sector.

Aging also requires specific policy measures. The new leadership needs to focus on three issues.

First, support systems for the elderly require comprehensive reform. A program for old-age income support and healthcare is needed, financed through tax revenue. Financing should be based on accurate actuarial projections, with benefits and contributions designed to be sustainable. Initially the system could prioritize the elderly, poor and those with functional dependencies, rather than providing far costlier universal benefits. At a later stage, the coverage could be expanded.

The pension system has recently been strengthened, but much more is required. While coverage has been expanded, benefits are very low, and the system is financially weak. In addition to structural reform, the underfunded social security sector needs a large upfront financial injection. The 2-percent increase in social security expenditure planned by 2015 is insufficient.

Strengthening pensions also requires financial liberalization. A more sophisticated financial system, including a wider range of investment options and an open regulatory framework, would lay the foundation for the establishment of private pension funds to complement government efforts.

Second, labor markets need to be opened and the workforce expanded. The household registration (hukou) system and restrictions on the portability of social benefits hinder migration, geographical mobility and, ultimately, urbanization. Compounded by skill shortages, they impede China’s movement up the value chain. The 12th Five-Year Plan (2011-15) envisages a gradual dismantling of the hukou system, and the new leaders have indicated their intention to improve living conditions for China’s 220 million migrant workers. These efforts should be accelerated.

In line with high-income countries, China should also consider raising the retirement age. The current general retirement ages, 60 for men and 55 for women, date back to 1950, when life expectancy was much lower. China may also need to consider other measures to increase labor supply, such as reviewing immigration policies.

Third, workers’ skills need strengthening, and productivity and innovation need to be enhanced. Otherwise, deficits in the labor force will erode the country’s competitiveness, reducing exports and economic growth. Substantial investments in research and development and a shift toward student-centered education are essential to increase labor productivity and support innovation.

As production becomes more sophisticated, the technical and vocational skills of the workforce are increasingly important. Skill development must be aligned with labor market needs and help companies respond flexibly to changing circumstances. China currently suffers from skill shortages in several sectors, and a rapidly aging population is likely to reduce labor market flexibility.

Greater investments in human development will result in higher labor productivity and help indigenous innovation to take root. High literacy rates and universal primary education are not sufficient for China to raise incomes. Tertiary education, and technical and vocational education need to be aligned with the country’s development strategy, supported by private and public initiatives. The government must ensure that all income groups have an opportunity to acquire the skills demanded by innovation-driven growth.

The new leadership has embraced the need for reform. China’s strong fiscal position provides ample room to finance the transition to consumption-based growth, supported by increased public spending. The two annual sessions present a unique opportunity to broaden what is already an impressive and far-reaching reform agenda.

Source:This article was first published by the Asian Development Bank (www.adb.org).