Starting January 1, 2018, most financial institutions (FIs) in IFRS-compliant countries around the world will switch their impairment reporting basis from IAS 39 to IFRS 9. Much has been discussed about this transition from incurred to expected loss accounting, but which portfolios will feel the most pain from the change, and how can FIs organise themselves to manage the impact most effectively?

Identify impacted areas

Certain products are inherently more affected by the change to IFRS 9. For example, the requirement to hold provisions against not just drawn balances but also undrawn commitments significantly impacts credit card portfolios, as expected credit loss (ECL) calculations must consider what balances will be when they default, not just what they are today. Models that capture this ‘exposure at default’ (EAD) reflect the tension between the customer’s desire to access available credit when under stress, and the FI’s desire and ability and to stop them from doing so.

Desire may be constrained by profitability or customer service considerations. The trade-off between risk and reward shifts under IFRS 9, but certainly does not disappear. Evaluating the new ‘sweet spot’ for profitability and returns will allow FIs to re-align their portfolio mix, pricing and product structure to optimise their financials. Customer service still matters – potentially profitable long-term business may move elsewhere if adverse decisions are taken against them prematurely.

Ability may be constrained by technology, systems or regulations. Developing high-quality IFRS 9 models using a wide range of reliable data, and investing in related infrastructure and technology, are both essential for FIs to apply accurate analytical insights in a timely manner. In some jurisdictions, however, regulations limit the ability of FIs to take responsive adverse actions even where they have the technological wherewithal to do so.

Prioritise volatile segments

Some products are inherently more responsive to changes in economic conditions. In a benign macroeconomic environment, for example, a typical mortgage portfolio might still only attract minimal levels of impairment under IFRS 9, due to the value of the security, after considering forced sale discounts, legal costs and other transaction costs that reduce the net sale proceeds. The requirement to consider a probability-weighted outcome will force the raising of at least some provisions for most segments to reflect the possibility of a sudden deterioration in external conditions, however remote.

Once a downturn becomes more probable, though, provisions can rise quickly. Not only will the probability of default (PD) increase, the ultimate loss given default (LGD) will rise rapidly as well. If the net proceeds of a property sale are expected to fully cover the EAD, then LGD is zero. Once that is no longer the case, LGD becomes non-zero and ECL begins to rise in line accordingly.

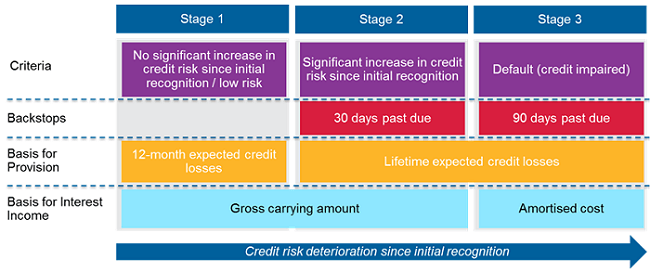

The IFRS 9 ‘forward-looking’ framework further amplifies the effects of a deteriorating economic outlook. Provisions take a step-change from a 12-month ECL basis to a lifetime ECL basis when accounts move from ‘Stage 1’ to ‘Stage 2’.

Stage 1 captures most new accounts and other accounts where the credit risk has not ‘increased significantly since initial recognition’. In contrast, Stage 2 accounts fail that test, either because they are more than 30 days past due or because their credit risk has otherwise significantly increased since initial recognition. Note that this can occur either because of individual account behaviour (e.g., delinquency on the mortgage account or other loans) or because of expected macroeconomic conditions (e.g., where the property is in a market that is expected to be adversely affected). The migration from Stage 1 to Stage 2 is especially impactful for accounts with long average remaining lifetimes, such as mortgages.

The multiplier effect of an increasing PD rate, increasing LGD rate and move from 12-month to lifetime ECL basis affects some products more than others. Understanding IFRS 9 impacts across a diverse product portfolio requires tailored models and sufficient planning and analysis time ahead of the compliance deadline.

Clean house, then keep the house clean

Armed with a sound understanding of both the expected and potential impacts of IFRS 9, FIs can begin planning and prioritising actions to manage provision levels.

Some planning and portfolio ‘clean up’ activities are required ahead of the compliance deadline to minimise the capital impact of the transition. Most FIs will take Day 1 impacts through their balance sheets by using retained earnings to ‘pay for’ the increase in provisions. Exact impacts are dependent on the capital regime being followed, but typically lead to a reduction in Core Tier 1 equity that is not offset by risk-weighted asset reductions due to higher provision levels.

Mitigating Day 1 impacts requires balance sheet actions that are feasible, effective and appropriate. These might include targeted asset sales, closure of dormant accounts and reduction of unused credit lines for higher risk accounts. Prioritising collections activities based on their IFRS 9 provision impacts can also improve the balance sheet position and instil strong operational practices ahead of the compliance deadline, when such activities will become ‘business as usual’.

Managing provision and capital levels over time requires ongoing review of portfolio mix, credit strategies across the lifecycle, and product pricing and design.

Extend the invite list

IFRS 9 is already a complex initiative involving numerous stakeholders across Risk, Finance, Accounting, IT, Governance, Financial Reporting and Audit. Given the emphasis on achieving compliance, it is understandable that IFRS 9 programme teams have been kept as focussed as possible, rather than inviting a complete set of stakeholders from the beginning.

That said, business and credit lifecycle management teams need to be made aware of IFRS 9 impairment impacts and drivers now, if they have not been already. They will need time to understand the changes and how IFRS 9 will affect the financial impact of their strategies, plus further time to make the appropriate changes both before and after the change-over date.

Accounting standards do not change overnight – IAS 39 went into effect in January 2005 – so preparing the business for the change should be done thoughtfully… but soon!

David Binder is global IFRS 9 programme lead at analytic software firm FICO. David previously led Barclaycard’s global impairment, capital demand and stress testing team, and worked on behalf of major financial institutions worldwide for US-based financial services consultancies.