Amsterdam-based “Bloqhouse Technologies” is a FinTech start-up, whose sole mission is to disrupt the investment market through the unique benefits offered by new technologies. The venture is simplifying the traditional, time-consuming and complex investment methods for the 21st century tech-savvy generation, by digitising the processes and allowing investors to complete KYC and onboarding online, while remaining true to the industry rules and regulations. Bloqhouse’s platform also provides an easy-to-use interface that connects fund managers and investors in new and innovative ways.

In today’s episode of the “Start-up of the week,” International Finance will talk in detail about the venture which claims that its software products reduce friction, cut costs and provide an unprecedented

digital experience for both investment managers and their investors.

Knowing Things In Detail

As of June 2024, Bloqhouse’s software solutions are helping more than 60 prominent fund management companies, when it comes to reducing friction, ensuring cost optimisations and providing an unprecedented digital experience for both investment managers and their investors.

Bloqhouse’s software solutions are also handling over 1.4 billion euro under their administration, apart from funding more than 460 investment projects to date. Bloqhouse received a massive boost in 2022, in the form of Sweden-based relational blockchain platform ChromaWay. The Swedish company invested 2.1 million euro in the Amsterdam-based investor management platform, apart from forging a partnership to bring innovative tokenisation solutions to the real estate industry.

ChromaWay and Bloqhouse now have a joint offering focused on digital asset investing through a distributed ledger using the Chromia blockchain. Bloqhouse’s cloud-based, one-stop-shop funding platform that meets all the current and future needs of fund managers, investment funds, and companies looking to raise capital, is now providing users with more transparency on the ledger and access to liquid assets initially via peer-to-peer transactions, through the partnership with ChromaWay.

Why the partnership a game-changing one? Just like Bloqhouse’s pioneer cloud-based, one-stop-shop funding platform, ChromaWay has disrupted the blockchain industry by introducing a “Relational Blockchain Platform,” a new virtual architecture that combines the power and flexibility of a relational database and the fault-tolerant decentralised security of a blockchain.

What Are Bloqhouse’s Key Products?

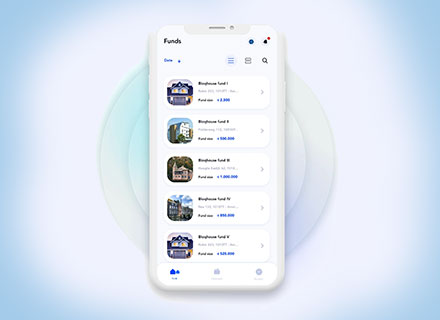

Bloqhouse’s “Fund Management Solution” has been tailor-made for modern fund managers. It’s the ideal choice for the next generation of fund managers, given its capability of enhancing the overall user experience for both managers and investors.

The “Fund Management Solution” comes equipped with an “Admin Portal,” that serves as a centralised control hub designed for system administrators to efficiently manage and oversee various aspects of the platform. This comprehensive interface provides administrators with the tools and information needed to monitor system performance, user activity, and system configurations.

After “Admin Portal,” the second most important element in the “Fund Management Solution” is the “Investor Dashboard,” which offers investors a user-friendly interface that provides real-time information and insights into their investments. Investors can access key metrics, performance data and documents allowing them to track their investments, before making informed decisions about their portfolios.

The third component of the architecture is “Investor Onboarding,” which is a guided virtual process that assists new investors in registering and setting up their accounts. This streamlined procedure ensures a smooth and user-friendly experience for investors, reducing friction during the onboarding process.

Talking about the simplified digital KYC features of the “Fund Management Solution,” the verification process enhances the onboarding process by streamlining identity verification for investors. This feature automates the collection and verification of necessary KYC information, ensuring compliance with regulatory requirements, apart from expediting account approval, thereby allowing investors to start using the platform more quickly.

“Fund Management Solution” also has its own “Online Marketplace,” which serves as a digital platform where various projects/investments can be bought and sold. This marketplace provides a secure and transparent environment for users to explore and engage with a diverse range of investment opportunities.

The “Fund Management Solution” also comes with “Digital Contracts,” replacing traditional paper contracts by offering an electronic platform for creating, signing, and storing contracts. This feature enhances efficiency, reduces paperwork, and ensures the security of contractual agreements. The system includes features for electronic signatures, version control, and secure storage, contributing to a more streamlined and eco-friendly process.

Also, the tool has been integrated with “Payment Service Providers” on the Bloqhouse platform, through which fund managers and investment platforms can rely on a reliable and advanced solution for managing incoming and outgoing payments. This enables these professionals to provide an efficient and secure payment process to their investors, resulting in an improved user experience and higher customer satisfaction.

The final component of the “Fund Management Solution” is something called “Bulletin Board Trading Functionality,” which offers a powerful bulletin board trading functionality, enabling buyers and sellers to identify and connect with each other. This functionality allows for peer discovery without the need for an order book or order matching, apart from facilitating private security resale transactions to investors.

Solutions For Marketplace Lending And More

Bloqhouse’s “Marketplace Lending platform” has been designed for the next generation of private credit and crowdfunding platforms, aiming to streamline capital raising and enhance the investor experience, thereby making it the ultimate choice for modern private credit and crowdfunding platforms.

Another tool is the “Captable Management Platform,” which takes care of the challenges posed by corporate finance, especially when it comes to law firms, and private equity companies looking to provide their clients with a captable management solution. While “Marketplace Lending platform” shares similar features like “Fund Management Solution,” “Captable Management Platform” has evolved into a personalised dashboard for captable participants, offering insights into returns and transactions, apart from serving as a centralised repository for crucial documents such as participation rules and valuation reports.

The “Captable Management Platform” comes with an “Investor/Employee Dashboard,” that ensures that investors and employees have a personalised and visually intuitive interface, fostering engagement and allowing easy access to critical stock-related information and tools.

The interactive tool serves as a central hub for stakeholders to monitor their investments or equity holdings and make informed decisions. The platform has another feature called “Employee Stock Ownership Tracking,” which provides a comprehensive solution for monitoring and managing employee ownership, ensuring transparency and helping employees stay informed about their stock holdings and transactions.

Then we have “Automated Vesting,” which automates the tracking and execution of vesting schedules, minimising administrative burdens, ensuring accuracy, and keeping employees informed about their equity vesting milestones through timely notifications.

“Captable Management Platform” also comes with “Equity Plan Management,” which streamlines the creation, modification, and administration of equity compensation plans, thereby providing administrators with an efficient platform to manage diverse equity instruments and participant details.

It is followed by “Management Reporting,” which offers customisable reports and insights, thereby empowering management to make informed decisions by providing a deep understanding of key metrics, equity performance, and compliance status through dynamic and tailored reports. It facilitates data-driven leadership, enabling proactive management strategies based on real-time and historical equity data.

Also, “Automated Communication” enhances the whole architecture’s efficiency by automating communication processes, delivering timely notifications, updates, and alerts to relevant parties, ensuring that stakeholders are well-informed about critical events and policy changes, thereby fostering a responsive and communicative environment, minimising delays and improving overall engagement with investors, employees, and other key stakeholders.

DLT Services

“Distributed Ledger Technology,” or DLT, has emerged at the core of Bloqhouse’s asset tokenization platform. Through ChromaWay, the start-up’s platform offers a secure and decentralised solution for managing financial instruments.

“Recently, the underlying tokenization smart contract was audited by the renowned security firm Hacken, and we are happy to have received a score of 10 out of 10. This audit confirms the robustness of our platform and gives users peace of mind when it comes to security,” Bloqhouse stated further.

Through DLT, a customer can connect his/her decentralised wallet to the fund manager account and create a new fund with just a few clicks on Bloqhouse’s portal, following which they can start minting their asset tokens and make them visible on the shared database, before publishing the funds and start accepting investments.

“Investors simply need to verify their identity, sign a digital contract, and process payment to finalise their investment. The investor portal allows for easy connection to their decentralised wallet and whitelisting for exclusive access to certain tokens. Claim your tokens and store them on your wallet, all registered on the shared database,” Bloqhouse stated further.

DLT is a part of ChromaWay’s Ledger Digital Asset Protocol (LDAP), through which sponsors can reach more investors while reducing the cost of issuance. On-chain issuance removes the need for intermediaries like brokers and centralised asset repositories, reduces compliance costs, and makes investment products with stable returns available to much wider investor segments worldwide.

The LDAP protocol is designed for a variety of projects issuing investable asset-backed tokens across a variety of industries including real estate, lending, climate projects, and start-up capital investments.

Image Credits: Bloqhouse