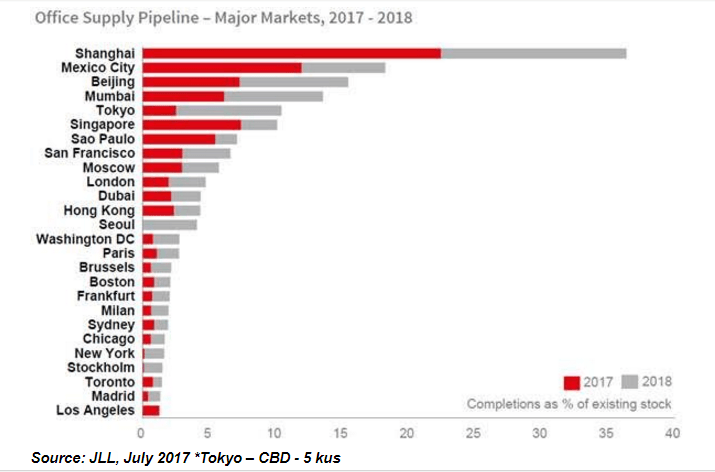

Mumbai is among the top-five cities globally that will see the maximum addition to its office footprint in the next 18 months, according to a recent JLL report. Mumbai figures after Shanghai, Mexico City and Beijing – among 99 cities studied globally. The financial capital of India is expected to add up to 14% of its current stock to grow its office footprint.

As the current total of Grade-A offices in the city is 109 mn sft, a stock of about 16 mn sft could be added in the next one and a half year as per construction schedules announced by developers. There is a probability of delays, based on historic trends, in which case the supply figure could be around 13 mn sft, which is also significant.

Interestingly, in this survey covering all office sub-markets in each city, the markets from emerging economies figure prominently in the top-10 list. Shanghai comes on top with 37% of its current stock to be added in the next 18 months, followed by Mexico City and Beijing adding 18% and 16% respectively.

The other cities from emerging economies that figure in the top-10 list include Sao Paulo (7%) and Moscow (6%). Cities from mature economies figuring in the top-10 lists are Tokyo, Singapore, San Francisco and London. Tokyo is expected to add 11% of its current stock through 2018 followed by Singapore (10%), San Francisco (7%) and London (slightly less than 5%).

What’s expected in Mumbai?

While Mumbai’s supply pipeline consists of office projects launched years ago, it remains to be seen whether they would all get constructed over the next 18 months. Also, the supply pipeline could dry up in the existing business districts over the next 2-3 years while a major chunk would come up in the emerging business districts and will, therefore, not help much.

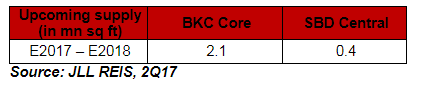

For example, a look at the core BKC area and SBD-Central (Lower Parel, Elphinstone Road, etc.) reveals that only 2.5 mn sft – out of the 13-16 mn sft that will enter the market through 2018 – would be in the key demand areas while an overwhelming majority of the rest will come up in the upcoming locations.

Interestingly, the finalised ‘Development Plan 2034’ has proposed an FSI of 5 for commercial projects in the city in an attempt towards re-densification of centric locations of Mumbai and would better allow further utilisation of premium lands. It, however, has to be very well-planned given the pressure on infrastructure in the city.

On one hand, we have established office districts where the new DP is proposing further densification but the existing infrastructure is not geared towards handling re-densification. On the other hand, emerging business districts that are farther from the city centres have local infrastructure that is better suited to handle further densification.

The DP has also opened up a possibility for older buildings to get refurbished. Some of these buildings would also be able to successfully become grade-A assets and add to the city’s office supply. However, it’s easier said than done as many of the older buildings are strata-sold and to arrive at a consensus among all occupiers would take considerable time. Thus, this would be essentially a long-term supply, not available in the next 18 months.

Ashutosh Limaye is National Director & Head – Research at JLL India