U.S. bankers and insurers are trying to use trade deals, which can trump existing legislation, to weaken parts of the Dodd-Frank Act designed to prevent a repeat of the 2008 financial crisis.

U.S. Bankers and Insurers are trying to use trade deals, which can weaken the Dodd Frank legislation designed to prevent a repeat of the 2008 crisis. While companies say they are seeking agreements that preserve regulations and economic growth, their efforts are drawing opposition from groups who argue that Wall Street wants to make the trade negotiations a new front to change or alter the law. Senator Elizabeth Warren who sits on the Banking committee was quoted saying there are “growing murmurs About Wall Street efforts to make changes in the trade agreements on what cannot be possible under public glare with the lights on and people watching”. The U.S. had embarked on three major negotiations aimed at reducing barriers to international commerce, the first with the European Union covering most types of trade and investment and a second one with the Asia Pacific nations covering the same aspect of earlier agreement and a third set of talks, covering only services, which is under way at the World Trade Organization. The coalition of service industries, a trade association whose members include Citigroup Inc., J.P Morgan chase & co, American International Group and the Chubb Corp as members have told the office of the U.S. Trade Representatives in a May 10th letter calling for “more compatible regulations for services” should be a part of the EU deal. They said “The provisions can be accomplished without prejudice to regulators authority to adopt or maintain regulations for consumer protection, environment, health, safety or prudential reasons.” the letter said.

The Securities Industry and Financial Markets Association, Wall Street’s biggest lobbying group, in a letter dated 1st March, said that liberalization of trade in financial services “is often incorrectly equated with deregulation”. In separate letters on the EU and Asia-Pacific pacts they have urged to draft rules limiting what regulators can do in the name of protecting financial stability. The coalition has also urged that the agreements should limit any rules that can go beyond the borders of the U.S., like the rules about financial derivatives.

The Dodd Frank Act

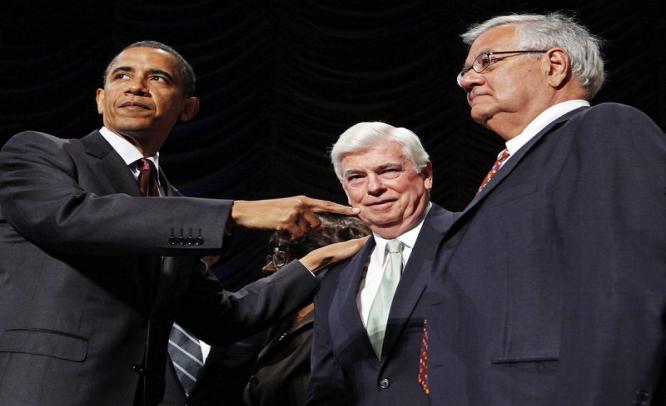

The Dodd Frank Wall Street Reform and Consumer Protection Act was signed into federal law by President Obama on 21st July, 2010. This was the largest financial regulation overhaul since the 1930’s. The law is named after its democratic sponsors in congress, Senator Chris Dodd and Representative Barney Frank. The law is aimed at preventing a repeat of 2008 financial crisis. The act which spans 2000 pages contains rules and regulations for banks, hedge funds and complex financial transactions called derivatives.

Precedence over Legislation

In the words of Mac Destler, professor at the University of Maryland who studies the politics of trade policy viewed “the negotiators could include provisions in the trade agreement that do less than simply reverse the existing legislation’. For example they could include deals to consult in the future where rules on finance conflict, or declare that current regulations are grandfathered to a trade pact”.