TPI Polene Power Plc (TPIPP), a leading operator of Municipal Solid Waste (MSW)-fired power plants in Thailand has been awarded the ‘Most Innovative Green Practices Towards ESG – Waste Management’ at the International Finance Awards 2022. This is the second award in a row for the company. Earlier in 2021, the TPIPP was awarded for the ‘Most Innovative Initiative Towards Waste Processing Plant’. The International Finance Magazine (IFM) caught up with Khun Pakkapol Leopairut, Executive Vice President to discuss what further strides TPIPP has taken toward its journey to becoming a greener company.

IFM: In last year’s award, we were highlighting TPIPP’s power plant operations relating to the use of municipal solid waste (MSW) as fuel. How have the operations been affected by the disruptions relating to the COVID-19 pandemic?

Pakkapol: TPIPP processes between 8,000-10,000 tons per day of MSW to run our Waste to Energy (WTE) Power Plant. Despite lockdowns and mobility restrictions in the past two years, we handled similar volumes of MSW during the year. In addition to various types of boilers suitable for MSW, we have developed our very own version of the mechanical and biological treatment (MBT) plant that allows us to handle unwanted MSW. And, a matter of pride for us that confirms the significant role that we now play in disposing MSW, TPIPP was granted a license to dispose of COVID-19 waste that due to its very nature requires extra attention in handling and demands high standards of safety which are incorporated in our safety system.

At this point, TPIPP remains the largest MSW power plant and processor in the Association of Southeast Asian Nations (ASEAN) and the largest in the world in a single location with a zero-waste policy. We have also begun the roll-out of our medium-term projects. Firstly, to switch our 220MW coal-fired power plants to run on MSW and secondly to support the move of our parent company, TPI Polene Plc (TPIPL) to run its cement kilns with alternative fuels (AF) replacing coal. Upon completion of these projects, TPIPP’s operations will eliminate more than 19.5m tons of CO2 equivalent and will be 12.6m tons below carbon neutral by 2026. Overall, this will advance the TPI Group’s goal to achieve net zero GHG far ahead in timeline compared to our local peers.

IFM: Energy inputs have become a significant cost swing factor especially starting second half of 2021 and at this point, it does not look like the price trend is going to revert to historic norms. How has TPIPP coped amidst the rising cost of energy production?

Pakkapol: Our 180MW capacity that operates on MSW and the 40MW that runs on waste heat have been insulated from the rising production costs. As for our coal-fired power plants, some are under plant improvements in preparation for the switch to the MSW fuel, so our coal input has been lower. Overall, especially this year we exercise cost optimization in order to remain profitable while at the same time meeting our power purchase agreements. Externally, we also benefited from the government’s mandated Ft adjustments during the year that added about THB1.1 per unit compared to the tariff in 2021. This has helped offset the rising cost, and we expect the supportive power pricing structure to remain throughout this year and next year. Our investment shift to focus on increasing MSW input has been well-timed and will allow room to mitigate increases in the fuel inputs.

IFM: Apart from the ongoing projects in your existing facilities are there other new MSW projects in the pipeline?

Pakkapol: Under an ad hoc purchase power program of the government, TPIPP has clinched sales of an additional 40MW capacity valid for the next two years, at least. This new sales contract will allow us to maximize the utilization of our existing assets. In September, we received permission to hook up our facility to the national grid and we can begin delivery in December 2022. This way we can assist the government in increasing its power capacity that is derived from renewable power – MSW.

TPIPP has also been awarded two MSW power projects. One is the 9.9MW power capacity in the southern province of Songkhla with a Commercial Operation Date (COD) in early 2024. The second one is a 7.92MW power capacity in the northeastern province of Nakorn Ratchasima with COD in early 2024 also. For both projects, TPIPP will sign long-term power purchase agreements with the state-owned power agency, Provincial Electricity Authority (PEA).

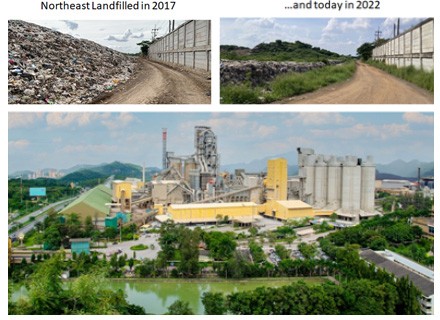

Songkhla and Nakorn Ratchasima are the larger and faster growing provinces in their respective regions. For example, the population of these provinces account for 17.2% and 13.6% of the Southern and Northeastern regions, respectively. In terms of economic contribution, Songkhla accounted for 19.8% of the GDP of the southern region while Nakorn Ratchasima accounted for 18.4% of the GDP of the northeastern region based on the 2019 national statistics. Thus, installing MSW-driven power plants in these areas will help address the ever growing waste accumulation and recycling it into higher value power production. The multiplier effect of having an MSW power plant is many folds spanning across health, economy and environment – areas that answer to the call for corporate social responsibility and the main tenets of ESG agenda.

IFM: From our observation, it has been quite some time that the Thai government has opened bidding for a sizable power capacity. Are there more potential projects coming up?

Pakkapol: According to the Power Development Plan 2018 revision 1, the government aims for 9,996 MW of new capacity coming from renewable energy, including hydropower. The government has plans to tender more renewable power capacity in the near future and TPIPP intends to participate especially in those that will allow TPIPP to expand the company further.

IFM: Over a period of less than a decade, TPIPP has harnessed the technology and the processes to convert MSW into fuel and achieve high profitability at the same time. At this stage what further defines your long term goal?

Pakkapol: All of our ongoing projects and activities including our parent TPIPL are about moves towards de-carbonization and green energy. Some 30-40 years ago, stakeholders in many companies typically worried mainly about returns and profit-generation. However, with the paradigm shift across the globe to the more pressing concerns on climate change and ESG-driven (Environmental Social and Governance) business-as-usual (BAU) operations our group’s goals have shifted as well. For example, at the parent company, TPIPL is switching from diesel trucks to EV (electric vehicle) trucks for mining activities and from using coal to MSW for the clinker process. For TPIPP we are switching from coal to MSW for electricity production and the medium term goal is to become a carbon-free power plant.

These moves re-enforce the group’s re-branding into a new era. TPI today stands for “Technology, Products and Innovation”, instead of “Thai Petrochemical Industry.” The group strives to use the latest, best disruptive technology and innovation to produce only world class products at competitive prices to answer our customer’s daily life needs. Moreover, the group will never stop innovating new processes and products to expand our businesses. Our motto since inception has been constant “We Build the Future”. We want the world to be a better place for our people to live happily and peacefully together. Our projects and investments have yielded benefits to all of our stakeholders on a consistent basis through the years.