Britain has released its strongest renewable performance in history. The power generated by renewable energy projects have overpowered fossil fuels for the first time ever—pointing to nearly half the electricity consumption in the country. What is interesting about the industry’s notable changes is that it has encouraged analysts, economists and environmentalists to firmly believe that it could play a powerful role in Britain’s green economic recovery. The truth of the matter is that the industry could—and would—help in the country’s climate ambitions if it is harnessed wisely. The companies tapping into wind, sea and solar energy have the potential to attract billions of dollars in investments and create thousands of jobs in the country.

The country has seen the renewable energy industry significantly contribute to its economic growth. While the traditional economic engines like banks and financial services companies continued to struggle leaving the economic growth to less than one percent as a result of the 2009 financial crisis, the economic value of offshore wind increased 17 percent and solar reached 7 percent. The Confederation of British Industry calculated that the green economy contributed a third of the country’s economic growth in 2011.

Renewable energy job boom is expected

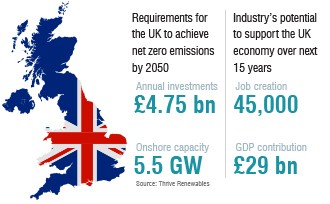

A report by Thrive Renewables observed that the country will have to build 5.5GW of onshore renewable energy capacity every year until 2025 to achieve its net zero emissions by 2050. For the same reason, it will also require £4.75 billion in annual investment, including £2.75 billion in onshore wind projects alone.. This in turn will lead to an investment opportunity worth £66.5 billion over the next 15 years. This implies creation of a renewable energy job boom. In fact, economists argue that the industry’s financial power coupled with strong public policy regimens could create an employment boom that might in fact be so impactful for the country in its post-Brexit and post-pandemic recovery.

A new report released by RenewableUK shows that renewable energy could have a significant positive impact on the economy if the British government capitalises on the existing and new benefits. The statistics of the report show that the industry can provide 12,000 new jobs and almost £20 billion of new investments as part of the country’s sustainable economic recovery. In fact, wind companies have already announced contracts and investments worth more than £4 billion. This in turn is anticipated to create an excess of 2,000 jobs despite an economic contraction on the back of imposed lockdown measures.

Thrive Renewables in its report found that onshore renewable energy projects will create 45,000 new jobs and inject almost £29 billion into Britain’s economy over the next 15 years. Additionally, it can help to save up to £1.5bn consumer energy bills a year by 2035. According to RenewableUK, the industry could secure 11GW of new onshore and offshore wind if policymakers lift capacity caps for the renewable energy auction slated to take place next year—and noted that the government can transform the country into a world leader in floating offshore wind, tidal power and renewable hydrogen projects.

Upgrade of renewable sites is a better alternative

The report also highlighted the fact that stimulating renewable energy expansion through upgrade of existing sites—also termed as repowered—with new and advanced technologies will see more opportunities underway. One way to revive existing wind sites after operating up to 30 years is by replacing their old technology with the latest turbines. For the most part, repowering of sites will be more productive, cheaper and faster to develop on the back of the existing infrastructures such as roads and grid connections. A combination of repowering and building of new onshore renewable sites is a powerful approach to the industry.

RenewableUK’s Director of Strategic Communications Luke Clark told the media, “The Prime Minister and the Chancellor want to build back greener; putting low-cost renewables at the heart of this agenda is a no-regrets option that will get investment flowing into the economy quickly and create jobs. Government has the tools it needs to put a rocket under renewable energy projects, which will make it much easier to achieve wider net zero objectives like the switch to EVs and low carbon heating. If we can support innovation and strategic investment in our offshore wind supply chain, alongside new cutting-edge technologies like renewable hydrogen and floating wind, the UK can be at the forefront of global growth sectors. The renewables sector is one of the biggest investors in UK infrastructure; boosting that will increase opportunities and employment, particularly in parts of our economy where we need to level up.”

Britain urges green spending

Britain urges green spending

The estimated figures have encouraged the British government to increase green spending because not doing so will only limit the industry’s potential, as many argue. Now, Siemens and EDF are in a coalition with local lenders in the country to pledge £5 billion toward renewable energy. Tapping into private sector investment would result in a net return of £100 billion to support the British economy which potentially includes £40bn for energy efficiency. This seems to exceed the defined target of £9.2 billion in the Conservative manifesto. A joint study published by Siemens and UK100 argues that a balanced energy system is required along with the right mix of local decentralised energy systems.

Most experts think the idea of a long-term, investible renewable energy policy platform is necessary to tear down industry barriers. Perhaps, more policy certainty over price stability in Contracts for Difference auctions, distribution network connection planning and cost structures will be highly beneficial to the industry. But here is the problem with policy development. Britain’s national planning policy needs to be amended to annihilate barriers for new onshore wind projects. However, the government announced plans earlier this year to allow onshore renewable energy projects to compete in upcoming CfD auctions, crafting a new route to industry potential. That progress can be made when a collective effort is seen with the government, companies and public trying to create a more sustainable policy landscape that will boost investor confidence.

Investors increasingly on board with energy transformation

A few weeks ago, Britain-listed renewable energy stocks increased 170 percent on average for the year. But the investment levels will have to continue for decades to meet climate change targets, observed finnCap in its latest report. The report points out that $350 billion in annual investment is required over a period of 30 years to meet the Paris agreement. Although investments in renewable energy remain solid, the current level of investment requirement is huge. For that reason, the country needs to maintain its inflow of investments in the industry over that period to ensure at least 50 percent of renewable energy mix can be achieved by 2050.

Interestingly, the report even highlights that IOCs need to make significant categorisations among themselves as ‘good energy’ and ‘bad energy’ companies to speed up the energy transition. In this context, good energy is associated with renewables and gas while bad energy largely covers oil, oil sands, refining, marketing and petrochemicals. finnCap research director Jonathan Wright, said in the report, “Clean, limitless in supply, increasingly competitive on costs, future-proofed, socially desirable and governmentally encouraged, renewable energy is here to stay. What’s more, with institutional investors increasingly focused on sustainability, even SMID cap oil and gas exploration and production companies are going to have to present a convincing ‘E’ component to their ESG strategy if they are to attract these investors.”

Interestingly, the report even highlights that IOCs need to make significant categorisations among themselves as ‘good energy’ and ‘bad energy’ companies to speed up the energy transition. In this context, good energy is associated with renewables and gas while bad energy largely covers oil, oil sands, refining, marketing and petrochemicals. finnCap research director Jonathan Wright, said in the report, “Clean, limitless in supply, increasingly competitive on costs, future-proofed, socially desirable and governmentally encouraged, renewable energy is here to stay. What’s more, with institutional investors increasingly focused on sustainability, even SMID cap oil and gas exploration and production companies are going to have to present a convincing ‘E’ component to their ESG strategy if they are to attract these investors.”

It is in fact important for small and medium sized oil exploration and production companies seeking long-term growth to build sustainability credentials in the coming years. For example, Shell and BP recently announced their plans for multi-billion pound write-downs of their fossil fuel assets. It is reported that investors are increasing in the country’s renewables in full support of the energy transformation. That said, companies that are still reliant on carbon-intensive assets will have to take progressive steps to stay ahead of the game.