Africa is already transforming, thanks to big investments fiercely led by Japanese banks to venture into the continental market—much like what China is doing.

Why is Africa of such importance to Japan and in what aspect? Interestingly, the Japanese are not new to the African market but have demonstrated deep interest in recent years. Already there are over 700 Japanese companies operating on the continent and it was only a question of time before they became more proactive.

Africa’s banking industry has a ‘refreshing contrast’

In 2018, a report published by McKinsey titled Roaring to life: Growth and innovation in African retail banking observed that the African banking industry provides a ‘refreshing contrast’, pointing to the fact that its markets are fast developing, yet there is great potential for future growth. One reason for that is because the African population is relatively young compared to developed economies with a large percentage of unbanked. The continent is still pushing poverty out in an effort to build financial inclusion—and in turn has created huge opportunities for foreign and domestic banks to work together on disruptive strategies. The report highlighted that 300 million Africans were banked in 2017 and the numbers could significantly rise to 450 million in 5 years since then.

“This makes it attractive in terms of building a young, upcoming customer base which is keen to embrace technology,” PwC Partner Francois Prinsloo told International Finance. “Some of the South African banks have been leading the technology journey in terms of customer experience and innovation and have received international awards on that front. For this reason and others, foreign capital issuances from the major South African banks have generally been oversubscribed, reflecting international investor confidence in South African banks and the South African banking system.”

Prinsloo makes a strong case that large South African banks have been well-regarded internationally on many fronts, including trusted brands and diversified franchises, returns on equity levels higher than their G-SIB counterparts, prudent approach to capital and liquidity management and experienced stable management teams who have embraced technological change for some time now. And this is another good reason for Japanese banks to seek collaboration with them for developmental initiatives.

South Africa, Nigeria and Kenya are recognised as mature markets with higher branch penetration. In fact, these competitive retail banking markets with high levels of mobile banking and long-time trade connections could be motivational factors for Japan to grow its stake in Africa.

JBIC supports trade between Africa and Japan

Last May, the Japan Bank for International Cooperation (JBIC) and a group of private financial institutions extended a $350 million export credit line with a tenor of up to 20 years to the Trade and Development Bank (TDB) operating in eastern and southern Africa. The proceeds from the credit will be used by Trade and Development Bank to financially help customers in Sub-Saharan Africa to import machineries and equipments from Japanese companies and their overseas affiliates. One important aspect of this move is that it will financially support Africa-bound exports from Japanese companies and build new opportunities for banks and trade companies. Previously, JBIC had extended a $12.5 million three-year export credit line in 2007 followed by a $80 million seven-year credit line in 2016.

Japanese banks become a prominent player

Japanese banks have become a prominent player on the continent trying new ways of doing business, making investments, getting work done—which in part is seen positively for the continent “as the interest in Africa grows, many investors consider the African continent to be a potential investment destination,” Prinsloo made a point.

The year 2016 was promising for Africa because it saw three largest Japanese banks seek business expansion into the continent. But the idea behind the expansion for Sumitomo Mitsui, Mizuho Bank and Mitsubishi UFJ was to help Japanese companies operating in Africa to tap the continental market and further develop the corporate sector.

First, Sumitomo Mitsui had established an agreement with Trade and Development Bank to offer loans up to $80 million to the African bank, along with JBIC’s credit line extension. Sumitomo Mitsui had also signed an agreement with the African Development Bank and Banco de Desenvolvimento de Angola for future developments.

Meanwhile, Mizuho Bank had agreed to form a business collaboration with Africa’s six financial institutions including the Zambia Development Agency and the Development Bank of Southern Africa to provide in-depth knowledge and enhance the banking sector on a large scale. Around the same time, Mitsubishi UFJ and the Kenya Investment Authority had collaborated under the terms that the bank would receive insights regarding new investment projects in Kenya which will be shared with Japanese companies operating in the country.

African banks become a beneficiary of such developments

As Africa becomes one of the prime investment destinations of the world, it not only lures Japanese companies for resources but also its fast-developing consumer markets. African banks have also become a beneficiary of such developments as it throws a positive light on their global reputation and potential in the banking industry. In short, the transactions seek to promote trade and investments in Africa.

The seventh Tokyo International Conference on African Development which was held last year led to the possibility of Sumitomo Mitsui signing five Memorandums of Understanding with African banks. It is reported that one of its partners will include Kenya Commercial Bank.

The Tokyo International Conference on African Development is quite beneficial to both Africa and Japan as it allows both of them to foster business collaborations on many levels. Last year it was reported that Sumitomo Mitsui offered financial services in 42 African countries and the number is expected to reach to 48 countries, or possibly even the whole continent on the back of these agreements.

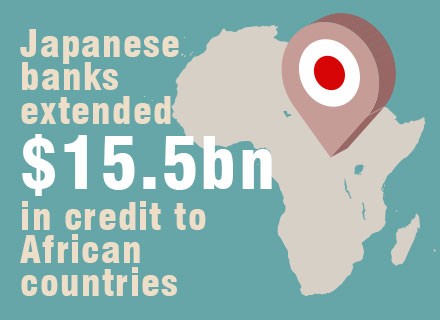

According to the Bank of Japan, the data showed that Japanese banks had extended $15.5 billion in credit to African countries last March, twice the amount from a decade ago. Even Mitsubishi UFJ has played an important role as the sole arranger, bookrunner and facility agent on $280 million and JPY 2.5 billion Samurai Loan for Afreximbank. This in fact marks the largest commitment from a Japanese bank for an African issuer—and is considered ‘historic’.

During the period between 2005 and 2014, Japan had announced $3 billion for the bank to support co-financing of projects in agriculture, water, health and infrastructure. Some of those examples include the Bujagali hydropower plant in Uganda, the Sahanivotry hydropower plant in Madagascar, the Lekki toll road in Nigeria and the Takoradi II gas-fired plant in Ghana. The relationship between Japan and Africa is long-standing with Mitsubishi UFJ’s involvement on the continent dating back to 1926. And that’s not all. Even Japan and African Development Bank are known for their profound relationship over the years.