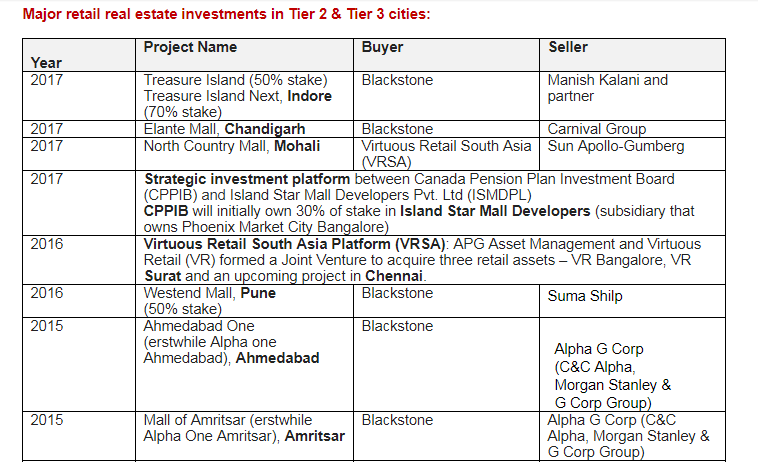

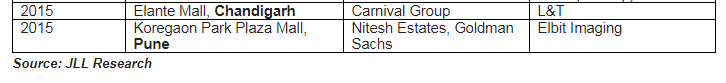

With retail assets becoming more lucrative thanks to the impending launch of real estate investment trusts (REITs) in India, the ticket sizes of investments into retail real estate (hitherto largely limited to the metros) has picked up pace in Tier 2 and Tier 3 cities. In fact, the period between 2015 and Q3 2017 saw an astonishing 54% of investments in retail real estate happen in Tier 2 and Tier 3 cities, well exceeding those into the metros.

Of the over US$1.57 billion of investment registered in retail real estate sector between 2015 and Q3 2017, more than half went into non-metro cities. This includes entity-level deals, platform deals and acquisition of stakes in malls. Some of the global private equity funds have been investing in the retail real estate sector to diversify their investment portfolios in India.

These are Tier 2 and Tier 3 cities which have investment-grade retail assets with the potential of generating good returns for investors after they are refurbished or upgraded into superior quality malls. Apart from Mumbai, investment largely took place in cities such as Pune, Bangalore, Amritsar, Indore, Ahmedabad and Chandigarh.

In some cases, investors intend to improve properties through various value-adding initiatives. This can be done by altering the tenant mix, adding hot retail categories and upgrading the food and beverage (F&B) offerings. It is now recognised that improving a mall’s F&B, entertainment and leisure component induces ‘placemaking’, generates more footfalls and increase dwell time – thereby helping retailers to boost their sales.

In cognizance of this, retail space investors are undertaking the necessary upgradation steps after acquiring the right retail assets. Interestingly, such investors are opting for both new mall projects as well as operational ones. The proportion of investment has been quite high in case of latter; however, in the last 12-15 months, private equity funds have been committing to acquiring and developing greenfield retail real estate assets too.

In the future, investors will aim at remaining flexible enough to focus on options such as land, operating assets, and new mall projects that have the potential to be market leaders with the potential to draw significantly higher footfalls. Typically, the valuation of shopping malls by institutional investors will involve due diligence in terms of these criteria:

In the future, investors will aim at remaining flexible enough to focus on options such as land, operating assets, and new mall projects that have the potential to be market leaders with the potential to draw significantly higher footfalls. Typically, the valuation of shopping malls by institutional investors will involve due diligence in terms of these criteria:

- Location of the project

- Rental Income prospects

- Developer’s rating and background

- Lease revenue model

- Overall tenant mix

- Competition in the long run

- Lease churning opportunity

- Malls with the potential for upgradation through re-leasing or other practical approaches

- Associated risks and market conditions

Investment by PE funds in retail real estate assets will also bring a structured approach to leasing, leading to a more regular performance evaluation of brands within malls. Importantly, investing is as much about exits as it is about returns. As retail assets can become a part of the REIT portfolio, options for exits open up, which enhances the liquidity of such retail assets.

Pankaj Renjhen is Managing Director – Retail Services at JLL India