Ever heard about a bank operating without a physical branch? Well, Welsh businesswoman Anne Boden has made the idea workable through her venture ‘Starling Bank’, which was founded in 2014.

On May 2023, the United Kingdom-based challenger bank reported a record pre-tax profit of 195 million pounds, a six-fold increase from the same period in 2022. Starling Bank also saw Boden stepping down from the chief executive’s role, as she believed that Starling should not continue to have a shareholder as its boss. She still owns 4.9% of the company, apart from keeping a seat on the board as a non-executive director.

International Finance will discuss Starling Bank’s unique business model in today’s episode of ‘start-up of the week.’

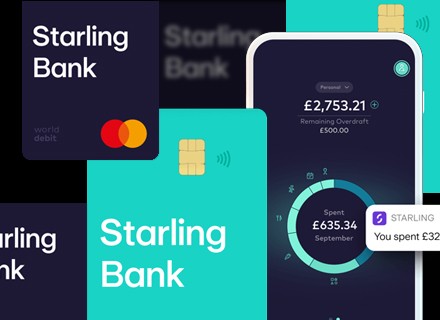

Starling’s Digital Bank Accounts

Be it budget maintenance, keeping a tab over even minute spending, paying bills automatically, hassle-free payments overseas, getting 24/7 bank assistance, name any customer concerns, the Starling Bank app is there to address them.

Starling’s award-winning, app-based current account ensures that customers don’t need to pay monthly fees, while applying in minutes for the service from one’s smartphone.

Starling’s digital bank account feature, which acts as the virtual branch on your smartphone, also comes with categorised spending insights, which helps to keep a tab over your spending and monthly/yearly budget.

A Brit can put his/her money aside in Starling’s ‘Virtual Change Jars’, which automatically round up transactions to save the change and give someone a ‘Connected Card’ if the person is spending the cash on the customer’s behalf.

Connecting with financial products mortgage, insurance or pension can also be performed through Starling’s virtual marketplace. Also through a payment link, a Starling customer can send his/her money to nearby customers of the same bank, apart from splitting the bills with a smartphone tap.

“Move all your finances over to Starling in a few taps by using the Current Account Switch Service. Lock your card with a tap. Use the app to lock your card if it goes missing – and block gambling transactions and payment methods, too. No fees overseas. Use both your card and ATMs freely when you travel, with no extra charges from us. All your admin, is in the app. Change your address, cancel your card, set up new accounts and more,” Starling stated.

Apart from pulling off international money transfers with no hidden fees, the customer can also control his/her banking overdraft and cheque deposits from the app itself.

Joint account holders can also set up ‘Bills Manager’ from their online accounts.

“Money for your bills will automatically be set aside – and paid – from a separate Space,” Starling commented further.

Also, Starling customers can hold, send and receive euros for free with the bank’s euro account feature. These individuals will get the current exchange rate with a 0.4% conversion fee added on top to cover their foreign transaction costs, apart from paying zero commissions and other hidden charges.

Customers can transfer money between their UK and Europe accounts on a 24/7 basis. The solution also provides the live exchange rate before the cash conversion is made, so the customers can wait for their ideal exchange rate before proceeding with the overseas money transfer. The whole function can be performed through a single virtual debit card and the customer doesn’t need to pay interest on his/her euro balance.

And last but not least, you have ‘Starling Kite’ and ‘Teen Account’, where British parents can imbibe the art of saving money for their offspring from the tender age of six, through virtual debit cards and online savings accounts.

Solutions For Businesses Too

You can apply for a free digital business account within the ‘Starling’ app and get the formality done at quick notice. Some 500,000 British businesses are reportedly using Starling’s digital business accounts.

The easy-to-use business account comes with powerful money management tools, apart from presenting a fully regulated UK bank account, where these businesses’ money will be covered up to 85,000 pounds under the Financial Services Compensation Scheme. All these services are free.

The business account can be customised further with the business toolkit, euro and US dollar-based transaction features. Generating and evaluating invoices, tax assessment, submitting VAT returns, exchanging and holding euros and dollars, everything can be performed online.

Breaking down monthly spending, sorting them across various categories, arranging files and payment receipts in order, setting a separate space for tax commitments, integrating with accounting tools, and depositing cash and cheques are some of the headaches business leaders face, and Starling Bank’s digital solutions are tailor-made to solve these roadblocks.

An Extensive Money Transfer Network

Starling claims of its exchange rates and fees, when it comes to overseas money transfers, are some of the best on the market.

“It’s fast. Our standard send is usually speedy – but if you’re in a hurry, you can opt to make a direct SWIFT bank-to-bank transfer (for a slightly higher fee),” it claimed further.

Starling Bank customers can send money to 36 countries in 20 currencies. They can also opt to make a direct bank-to-bank payment with SWIFT instead, for a flat delivery fee of 5.50 pounds.

“Send your payment via a local partner, for some currencies, it can take a little longer, but prices start at just 30 pounds per transfer. We’ll guarantee your exchange rate for 30 seconds, which means you’ll get the exchange rate you’ve been quoted, even if it changes. It’s only fair,” Starling Bank explained further.

The Road Ahead

Ariane Vickman has become Starling’s new head of public affairs. Vickman has a proven banking background, apart from being the former senior parliamentary assistant in the office of Conservative MP and former United Kingdom deputy Prime Minister Dominic Raab.

Also, taking its vigilance game to the next level, Starling has chosen Napier, a London-based intelligent compliance technology firm, for the bank’s Anti-Money Laundering and counter-terrorism financing commitments.