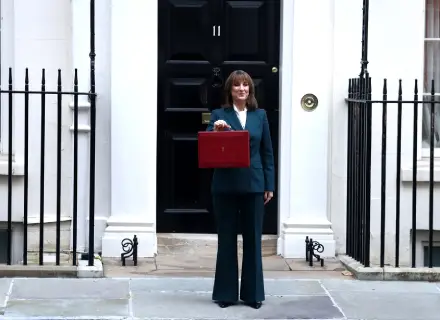

Recently, the much-awaited Budget from British Chancellor Rachel Reeves arrived and hit the media headlines immediately, due to the declaration of tax hikes, which overshadowed almost every other announcement in the budget.

While the United Kingdom is facing persistent inflation, a sluggish economy, and a budget deficit, Rachel Reeves now faces an uphill task: boosting GDP growth without raising inflation while also shoring up public finances. In her second annual budget, the Chancellor presented her solution: a mix of tax hikes, while raising public investments, reducing energy bills, and extending the fuel duty cut.

In her second annual budget, Rachel Reeves hiked taxes by around 26 billion pounds by 2029-30. With the latest hike, the United Kingdom’s taxes rose to an all-time high of 38% of the GDP over the next five-year period.

Also, more than 1.7 million workers will likely either enter the taxable bracket or move into a newer tax bracket as the Keir Starmer administration has extended the freeze on income tax and national insurance thresholds till 2028.

While the tax thresholds will remain the same, even as salaries will rise, it will make people enter taxable brackets or move into higher brackets. Rachel Reeves has described the move as “taxation by stealth.”

In addition to the stealth tax, Rachel Reeves further targeted the European country’s rich with a new council tax surcharge for properties worth more than two million pounds. She also announced a 2% tax increase on income from dividends, savings, and property. She has now cut around 150 pounds off household energy bills from April 2026 by ending the Energy Company Obligation (Eco) scheme and funding 75% of the “Renewables Obligation.”

There will be a one-year freeze on regulated train fares, a freeze on prescription charges under the National Health Scheme (NHS), and an extension of a 5 pence a litre relaxation on fuel duty. The Keir Starmer government has estimated that these moves may bring down inflation by 0.4 percentage points.

To balance inflation management and growth, Rachel Reeves sought to bring the 0.4 percentage point reduction through targeted consumer price relief instead of demand-side tweaks that could have suppressed growth.

That’s why relief has come, why cutting duties and fares. She has also promised up to £ 120 billion in public investments to fuel growth, while estimating that public investments will be at the highest point in four decades with the move.

Budget Presented Amid A Delicate Situation

In 2025, the United Kingdom was not only one of the better performers among rich economies, but the International Monetary Fund (IMF) even said the European country was on track for the second-fastest growth in the G7 this year, only behind the United States. However, then came the summer and autumn numbers, and disappointment followed again. In the third quarter, the economy barely grew at all, just 0.1%.

Another headache has been government borrowing, which from April to October, reached its highest level since the COVID pandemic years. A big chunk of this was routine operational spending, the same category Rachel Reeves has promised to bring back into balance by the end of the ongoing decade. But with day-to-day borrowing hitting the 84-billion-pound mark, around 10% higher than in 2024, closing that gap won’t be simple.

While Rachel Reeves’ 2024 budget raised the minimum wage and increased employers’ national insurance contributions, companies have since been complaining about the pressure the policy has placed on their staffing budgets. While a slowed-down hiring has become the new normal, payroll data for September and October showed their steepest two-month drop since late 2020.

The unemployment rate has climbed back to 5.0%, the highest level in almost five years. Pay growth is also losing momentum. Average wages in the third quarter were only 0.5% higher than they were a year earlier. The ratio is a long way from the rapid pay rises British workers saw when inflation

was surging.

Households are tightening their belts too. In October 2025, retail sales, along with consumer confidence, fell for the first time since spring. The GfK index edged down in November, and the British Retail Consortium noted the biggest drop in shopper sentiment since April.

Talking about the thorn called inflation, the ratio, after falling sharply through 2024, ticked back up to 3.8% over the summer of 2025. Higher employer taxes added to business costs and played a role in that rise. Since Labour’s 2024 election win, the Bank of England has cut interest rates five times.

Even then, the rate sits at 4%, still twice the level set by the European Central Bank (ECB). Governor Andrew Bailey is open to easing the BoE’s monetary policy again if inflation continues to soften, while the Bank’s chief economist has taken a more cautious stance, saying he does not expect near-term data to change his view.