Dr Shane Oliver Chief Economist – AMP Capital

16th January 2014

It seems that every 6 -12 months the China perma bears roll out their worries again. At the core of such concerns are a bunch of structural issues: that China’s investment driven growth model is unsustainable, that its housing sector is overheated, that it has lost competitiveness and most significantly that it has taken on too much debt. However, much of these worries have been overdone. This note looks at why, starting with the cyclical outlook.

Growth cycle stabilising

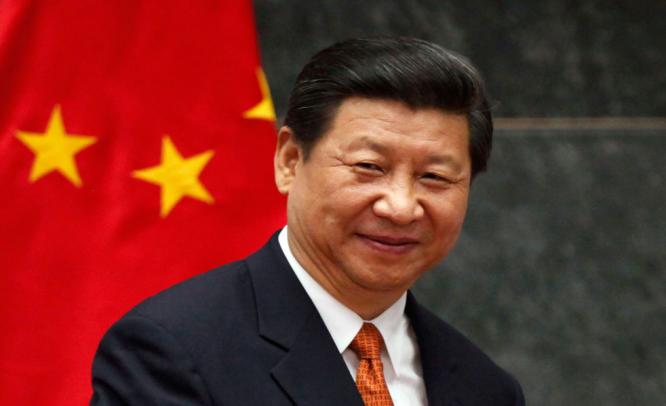

There is no doubt that the slowdown in China’s growth rate since 2010, when it peaked at 12%, to around 7.5% recently has caused consternation and unnerved investors. The uncertainty was made worse earlier this year by a patch of softer economic data, a mini liquidity crunch around June when the People’s Bank of China appeared to be trying to slow lending through the less regulated non-bank or “shadow banking” system and speculation that the new Chinese leadership of President Xi Jingpin and Premier Li Keqiang would tolerate much weaker economic growth.

However, since then concerns about China’s cyclical economic outlook have settled. First, Chinese leaders have repeatedly stated that the floor to acceptable growth is around 7 to 7.5%. For example Premier Li recently indicated that 7.5% was the lower limit based on an estimate that 7.2% growth is necessary to create 10 million new jobs each year which is what’s roughly required to cope with the migration of around 18 million people each year to urban areas.

Second, the liquidity crunch has eased with money market lending rates settling back around 3%, although there has been a recent spike to around 4% in an effort to mop up liquidity associated with capital inflows. They remain well below 13% peak seen in June.

Third, and perhaps most importantly Chinese GDP growth has picked up to 7.8% year on year in the September quarter. Consistent with this economic activity indicators have stabilised and perked up. October data showed:

- an improvement in business conditions PMIs with the manufacturing PMI in a relatively stable range since early last year, consistent with a stabilisation in GDP growth;

Source: Bloomberg, AMP Capital

- annual growth in industrial production running around 10.3% up from a low of 8.9% in June;

- retail sales growing 13.3% from a January low of 12.3%;

- electricity production up 8.4% versus 6.4% a year earlier;

- while growth in fixed asset investment slowed to 19.3% year on year, this is part of a rebalancing. More interestingly the slowdown was accounted for by slower investment by state owned enterprises with private firm investment stable at around 22% growth;

Source: Thomson Reuters, AMP Capital

- export growth appears to be trending up and import growth is solid at around 7.5%;

- while inflation has increased to 3.2% year on year this is due to an acceleration in food prices. Non-food inflation is stable around 1.6% and producer prices are still falling;

- finally, while money supply growth has remained solid at 14.3% year on year, growth in overall credit has slowed to a still strong 19.5% year on year from a peak in April of 22% and 37% growth in 2009 as the Chinese authorities reign in credit growth that has been occurring outside the banking system, ie “shadow banking”. But this looks to be a controlled slowing rather than a collapse.

The overall impression is that growth has stabilised and improved a touch with no sign of a hard landing and inflation remains benign. With monetary and fiscal policy remaining growth supportive, exports set to benefit from stronger global growth and Premier Li targeting a 7 to 7.5% floor for growth we expect growth to run around this level next year.

Debt is a worry, but nothing to panic about

The biggest concern is that a rapid build-up in debt starting in 2008 has led a domestic debt bubble. However, there are several points to note. First, China’s aggregate debt level is not high by global standards. See the next table.

* Includes local govt debt of 30% of GDP. Source: IMF, BCA, AMP Capital Second, the rapid rise in China’s debt level is partly a result of a very high savings rate and those savings largely being recycled via the banking system rather than via the share market which means savings are simply recycled into debt. Third, reflecting its very high savings rate (around 50%) China is the world’s largest creditor nation with the world’s largest foreign exchange reserves. The risk of a typical emerging market crisis where foreign investors lose confidence is low as China is not relying on foreign capital. Finally, there is no denying that the rapid increase in China’s debt is a worry if it continues and as rapid increases run the risk of poor asset quality. However, the authorities recognise this with a clear focus on slowing the “shadow banking” system and the new leadership indicating there is little scope for more monetary and fiscal stimulus and that the emphasis will be on economic reform to boost growth. While the Communiqué from the 3rd Plenum was long on clichés around “deepening” and “perfecting” and short on detail it is clear the focus will be on reforms to allow market forces to play a more decisive role in the economy. While details will take time to be released and the reform process will be gradual its likely this will focus on deregulating financial markets and removing bureaucracy amongst other things. What about the “housing bubble”? Talk about a housing bubble in China has hotted up once more as house prices have picked up again. And reports of “ghost cities” continue to circulate. The reality is far more complex with an undersupply of affordable housing, low home ownership and low levels of household gearing where average deposits are around 40% of values and 20% of buyers pay in cash. Household debt is low at 30% of GDP versus 85% in the US and 100% in Australia. And with household income growing around 10% a year it’s hard to argue there is a bubble when property prices rose just 2% in 2011, were flat in 2012 and look like rising 10% or so this year. While there are oversupply conditions in some cities and bubble like conditions in some others, overall it seems the Chinese property market is a long way from a bubble. The investment overhang, or is it? Talk of the need to rebalance growth in China away from investment to consumption has been around for a while. Over time it will happen. But it will be a very slow process. First, despite the strong growth rate of investment in China, its annual level of capital investment per person is low compared to developed countries. See the next chart.

Source: BCA Research Second, China’s urban share of the population at 50% is up from 20% in 1980, but if Korea is a guide its likely on its way to 80% over the next 30 years. This means an extra 400 million people moving into cities. To achieve this will require massive investment in housing and urban infrastructure. Finally, China has been able to grow so strongly because it hasn’t experienced the inflation and balance of payments crises experienced periodically by many underinvesting emerging countries like India, Indonesia and Brazil. In short claims that China is overinvested and investment needs to fall sharply relative to consumption are misplaced. Has China lost competitiveness? With Chinese wages rising rapidly, concern about a loss of competitiveness is quite common. However, there is little evidence this is a major problem. First rapid productivity gains are offsetting labour cost increases. Second, Chinese exporters have been moving up the value chain to higher value adding exports like electronic machinery. Finally, Chinese export are continuing to gain share, rising from around 4% of total global exports in 2000, to 8.5% in 2008 to 12% now suggesting little sign of a loss of competitiveness. The Chinese share market Chinese shares are cheap with a price to historic earnings ratio of 11 times and a price to forward earnings ratio of 8.5 times. This makes it one of the cheapest share markets globally and is suggestive of good returns in the years ahead as it becomes clear Chinese growth remains solid.

Source: Thomson Reuters, AMP Capital

Concluding comments

China is unlikely to return to the 10% plus growth of last decade. But growth does seem to be stabilising around a still strong 7.5% pace and many of the common concerns regarding China are overdone.

Source: AMP Capital