Africa’s financial services value chain is rapidly changing. The continent’s fintech revolution started because the continent has the highest levels of mobile penetration and unbanked population in the world.

A study published by Disrupt Africa on active fintech startups over the last four and a half years in 28 countries found that African fintechs have incrementally increased in number to 491 in 2019. In November alone, Nigeria’s payments companies received $400 million in investments—pointing to venture capitalists’ and especially China’s deep interest to gain advantage from the continent’s expanding fintech ecosystem.

The recent developments in fintech investment pose the big question—why is Africa slated to outmatch the top fintech investment destinations of the world?

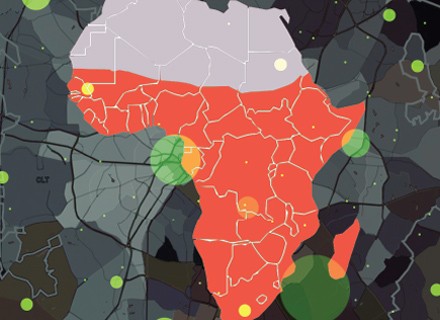

Sub Saharan Africa is the fastest growing fintech investment zone

A new GSMA research found that Sub-Saharan Africa is one of the fastest-growing investment zones for fintechs. “The region’s fintech landscape has grown at an annual rate of 24 percent over the last 10 years,” Dapo Adewole, who is responsible for leading the Technology and Digital Practice across Ernst and Young West Africa, tells International Finance.

The region’s fintech segment comprises more than 260 active companies, with 20 percent of them being international players. A leading independent newswire Medici conducted research last year that found that Nigeria and Kenya are the two African countries that boast the highest number of startups working toward financial inclusion.

These fintechs have already made a profound impact on the local people with rational approaches and nimble technologies. That coupled with a unique economic and demographic environment has established the Sub-Saharan Africa as an ambitious rival to evolving markets like Latin America and Asia. The fact is “it is characterised by a less-developed financial infrastructure and an unbanked population of about 66 percent as of December 2018,” Adewole explains, is the prospect for massive new fintech opportunities.

“Not hampered with what is now considered ‘old tech’ such as fixed phones, Africa has used the mobile phone revolution to increase financial inclusion across the continent. This wave of innovation has continued to develop, not just geographically, but as payments are linked to most parts of a digital merchant experience the growth of smartphone is bringing new opportunities to fintech. Consequently there are new opportunities in over the top smartphone-led initiatives such as PalmPay and OPay in Nigeria,” Greg Reeve, Director at PalmPay tells International Finance.

Mobile money startup OPay is capitalising on Nigeria’s 123 million unbanked, who account for 60 percent of the total population. “At OPay, we see this challenge as a major opportunity to deliver financial services for everyone with free, safe and easy to use mobile products under the promise of financial inclusion. Financial services should be available for everyone without regard for physical borders, boundaries or even social status,” Iniabasi Akpan, country manager at OPay Nigeria, said in an interview with International Finance.

In another example, ecommerce retail platform Jumia is helping to build the industry by solving every day challenges, including bills payment,s airtime recharges, loan approvals, or investment access. “The African fintech ecosystem offers tailor-made solutions that address local and specific customer circumstances,” Adewole explains, making them very attractive to global investors.

African fintechs: Major global investors at play

Venture capitalists have channelled huge investments into African fintechs highlighting Africa’s fintech revolution. In March, Mastercard invested $300 million in Africa’s largest payments processor Network International.

Investors put in $400 million in three payments startups in November alone. OPay, which is incubated by Chinese internet browser Opera, received $170 million funding in two series led by famed Chinese investors, including Sequoia China, IDG Capital and Source Code Capital — an equivalent of one fifth of all venture capital funds raised in Africa in 2018.

Visa announced a $200 million investment in Lagos-based Interswitch and local fintech PalmPay. Additionally, PalmPay received $40 million in a seed funding led by Chinese mobile phone maker Transsion.

An American investment firm Partech Ventures found that the total funding raised by the three fintechs represent a significant portion of the $1.2 billion in venture capital across the continent in 2018. Those fintechs emphasised that they would use the cash to expand into select parts of the region where only one-third of adults have bank accounts. This ties back into the formula that the unbanked population lacking access to the current financial developments have become one of the biggest boosters for Africa’s fintech modernisation — and for expanding investor interest.

“Global corporates like Visa and Stripe prefer to buy shares in Nigerian payment platform Interswitch and Paystack respectively considering their interest in Sub-Saharan Africa,” Adewole explains. Interswitch in a media report said Visa’s investment has valued the company at more than $1 billion — making it the first homegrown unicorn in Africa.

Also, three Nigerian fintech startups Kudi, OneFi and TeamApt raised $5 million each in funding in 2019. OPay, on its part, has been able to attract major investments because of a tremendous growth trend observed in Lagos, which ranks among the top 100 cities with a robust fintech ecosystem. Also, Lagos-based Flutterwave has established its own partnership with Visa and Chinese third-party mobile and online payment platform Alipay to offer a raft of digital payments between Africa and China.

“Things can move quickly when you get the right formula and are addressing the real underlying customer issues. There are now a number of companies with good investments addressing a number of areas. Some unfortunately will fail, others will pivot and find new opportunities and some will grow to be successful. I suspect that some will become very large over the 10 year timeframe. The important thing is that currently there is opportunity, market and talent — and that’s a strong mix. With the right investment and a bit of luck we will see more big success stories coming out of Africa,” Reeve explains.

Chinese money hot after African fintechs trail

China has become vital to Africa’s financial services scene with internationally recognised firms investing in local fintechs. In August, Qingliu Capital, Jiuhe Venture Capital and Shaka Ventures poured an undisclosed amount into Lagos-based mobile payments provider Gona.

The two Chinese giants Huawei and Transsion are collaborating with Africa’s fintechs through partnerships and smartphone sales. A year ago, Chinese investors would have set eyes on Silicon Valley for investment potential but that has now shifted. Their focus is being redirected toward Africa because of the prolonging trade war with the US and the continent’s sudden tech eruption.

Experts believe that Chinese investors constantly need to explore new investment markets — and for that reason, the next obvious destination would be Africa — where business and consumer landscape is primed for development in the coming decade.

Are African fintechs the hottest in the world now?

Sub-Saharan Africa leads the world in per capita registered and active mobile money accounts, outlets, and volume transactions which have set the region apart, in terms of observable trends in fintech growth and investments.

It should be noted here that early developments on the part of some companies have made African fintechs the hottest in the world now. The challenges Kenya’s first mobile wallet M-Pesa faced in cross-border paymensts is being addressed by a Nigerian startup Flutterwave. The startup has integrated Africa’s fragmented payments system through a single API allowing local merchants to make transactions anywhere on the continent and to accept payments from an M-Pesa user. In fact, a large number of mobile payment providers in Kenya have transformed the payment landscape to an extent that 45 percent of the country’s GDP came from mobile payments infrastructure.

Now the fintech presence can be strongly felt across most urbanised African countries. Sami Louali, who is the Executive Vice President for corporate development and financial services at Jumia, makes a valid point to International Finance, “Africa has the world’s youngest workforce with a rapidly increasing rate of smartphone use.”

Although the continent is a latecomer to the fintech revolution, it has leapt straight into it with a a modern mobile infrastructure. “Mobile ubiquity enables scale and speed-to market that makes the cycle of innovation and experimentation much faster than in other sectors,” MFS Africa founder and CEO Dare Okoudjou says in an interview with International Finance.

Jumia is focused on mobile technology and the creation of supporting infrastructure. Even OPay is opening up a suite of digital offerings because “Technology and infrastructure are key components for the adoption of fintech services around the world,” Akpan says. “Currently, OPay has greater ambitions to consolidate the brand positioning in Nigeria and plans to bring more vertical services such as ORide and OFood. It also has further plans of expanding brand visibility to other African countries like Kenya, Ghana and South Africa.”

A majority of evolved fintechs are closely tied to the region’s payments infrastructure creating new business models and unconventional practices. For example, Lagos-based startup PalmPay’s new payment app will be preinstalled on Transsion’s mobile brand Tenco as part of a tie-up, with an estimated reach of 20 million phones in 2020.

“Complementary business models in Sub-Saharan Africa have made fintechs attractive to both private and public investors worldwide and targets for mergers and acquisitions,” Adewole says. “Overall, the sector exhibits promising signs of accelerating growth, ample investment and business opportunities.” The merits of this ambitious mindset for growth among African entrepreneurs are pulling venture capitalists from around the world toward them.

Does the fintech regulatory ecosystem suppport growth?

Africa requires a powerful regulatory framework, presaging a new fintech era. “While current laws in certain jurisdictions offer guidance and moderate protection, they will need to be continuously updated to cover issues that will arise from the development of fintech products. It is already happening, but pan African companies such as Jumia would like to see more alignment and coordination between the central banks of the continent,” Louali says.

Some African countries’ regulatory frameworks have already put financial inclusion and innovation on the forefront for further development. “The regulatory environment across the continent is certainly adapting to the growing demand for fintechs as governments are starting to establish incentives. The regulations are aimed to balance the growth of the sector while providing appropriate protection for consumers. In a few other African countries like Uganda or Tanzania, regulators are receptive to fintech developments and they see fintechs as an important driver for financial inclusion,” Adewole explains.

Countries such as South Africa, Kenya, Ghana and Uganda have developed an advanced data regulation framework. Yet, they face challenges such as non-existence of centralised approach to fintech regulations and no single regulatory policy on fintech.

“Fintech regulations can vary among different countries, which is why we’ve seen that a localised approach is necessary to ensure success,” Akpan explains. Regulators believe that a traditional prescriptive regulation might suit stable sectors, while it is not ideal to define a set approach for fintechs as they will always encounter last moment crisis. As Akpan describes, “It’s not a ‘one-size-fits-all’ approach, so being thoughtful about expansion and actively monitoring the regulatory environment is essential as these companies scale.”

Another unique challenge Louali states is the differences in African ecosystems, where some economies are led by banks and others by telcos. So the venture capital investments are naturally pulled toward larger economies — making it difficult for fintechs operating in smaller markets.

In Okoudjou’s view, “Regulation must be progressive, proportionate, and pro-mobile.” It is now the mobile channels are more easily accessible and affordable for the marginalised and poor customers. So these customers should be positioned at the centre of any regulation.

Secondly, the proportionate factor that Okoudjou mentions points to the fact that low risk of low-value transactions will not increase as they cross a border. The risk of those transactions decreases considerably when using a mobile channel over cash. Thirdly, it is of utmost importance to embrace mobile that is the present and future of digital transformation. “Regulators can focus on ways to leverage the strengths of mobile channels, rather than the ways in which mobile money is ‘less than’ traditional banking services,” Okoudjou explains, as it will reinforce the benefits of the pro-mobile period for people in Africa.

Despite that, many African fintechs are facing challenges related to a somewhat uncertain regulatory landscape. According to Adewole, “The gap in adequate ICT infrastructure across Sub-Saharan Africa is a major challenge that leads to the failure of some fintech startups.” Paga, for example, started operations two years after being established because of constraints in obtaining an operating licence from the government.

Okoudjou says that real infrastructure challenges across the continent can be addressed with the help of platforms like MFS Africa that aim to connect various service providers including banks, mobile network operators and fintechs. For many, the continent’s fintech regulatory environment can be further improved by using social and economic impact assessment to outline regulatory priorities. That in turn will help to identify areas with insufficient domestic demand — or cherry pick the segment, technology or solution with the highest potential gain for the economy at large.

The unbanked frames the future of African fintechs

Africa’s fintech outlook heavily relies on favourable demographics, high mobile technology use and existing gap in financial inclusion.

“Fintech innovation is expected to increase in the region within the next five to 10 years. The number and diversity of African fintechs will multiply to provide innovative financial solutions to the large demography and customer segment including the untapped financially excluded market,” Adewole says. Sub-Saharan Africa’s fintech sector will continue to be dominated by payments solutions until the gap in financial inclusion is bridged. “It can be expected that the smaller segments will expand their footprints in the sector as consumers shift their attention to solutions that satisfy other previously underserved financial needs,” he adds.

The industry foresees a lot of market consolidation, especially in the next three to five years. “By examining the current ecosystem it will only become simpler and simpler to link mobile wallets at a continental scale,” Okoudjou concludes.