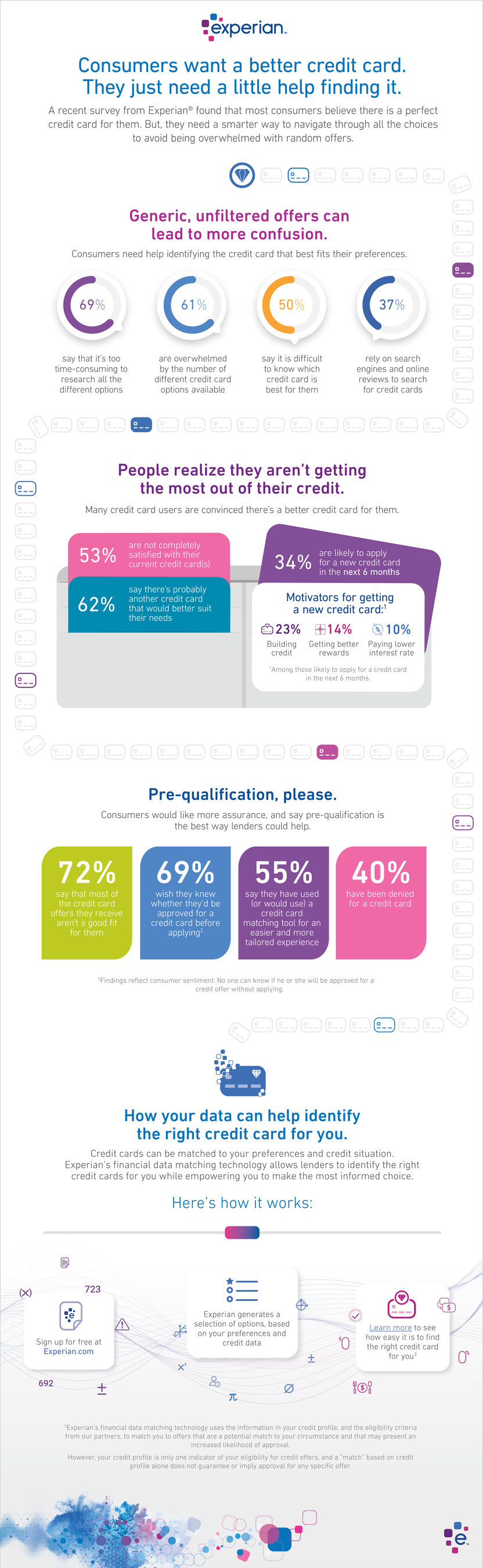

As consumers gear up for back to school spending and soon holiday shopping, they’re often looking for the “perfect” credit card to match their needs. Unfortunately, a national survey by Experian found that consumers are overwhelmed by the many credit card offers and find it difficult to navigate selecting the right card.

What do consumers want in a credit card?

- Fifty-four percent of surveyed respondents want no annual fee, while 45 percent of them want a rewards program.

- Among the top rewards, almost 90 percent of those surveyed prefer cash back and 74 percent of them prefer gas rewards.

- Thirty-three percent of surveyed consumers say credit cards can better meet their needs by having lower interest rates.

- Sixty-nine percent of surveyed respondents wish they knew in advance if they would be approved before applying.

It’s likely many consumers will continue to search for a better credit card option, as more than half (53 percent) of surveyed respondents are not satisfied with their cards. In fact, one in three surveyed respondents overall say they are likely to get a new card within the next six months. But the process of finding the right credit card is a challenge for consumers — 61 percent of those surveyed say they are overwhelmed by the different credit card options, and more than half (57 percent) agree it’s difficult to know which card is the best choice.

To help consumers get personalized credit card recommendations, Experian® has launched a solution that uses consumers’ own financial data that Experian houses to match them with more tailored credit card options.

“Consumers surveyed hold an average of three credit cards, which shows it’s been challenging to find a card that meets their needs,” said Guy Abramo, president of Consumer Services at Experian. “Experian has been an essential resource to consumers regarding credit matters, and we’re pleased to launch a new capability to help them finally find the right card. Consumers don’t need to spend time sifting through random offers. The cards we recommend will have the key attributes they’re looking for and increase their likelihood of being approved. They can now find the right choice by using Experian.”

Many consumers want a tool that can match recommendations. Almost 40 percent of those surveyed haven’t used a tool to find a credit card before, but are interested in trying such a resource. Currently, 37 percent of survey respondents say they rely on just doing their own online searching and 21 percent read online reviews.

About Experian

Experian is the world’s leading global information services company. During life’s big moments — from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers — we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have more than 16,000 people operating across 37 countries and every day we’re investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.