In 2002, a transformation from a conventional banking system to a full-fledged Islamic banking system saw Bank Rakyat grow into one of the most stable banks in Malaysia, recording encouraging profits year after year. It was recognised as the Strongest Islamic Retail/Cooperative Financial Institution in the World by the Islamic Retail Banking Awards 2016.

This remarkable growth has been due to prudent asset management and banking practices. From 2011 to 2014, the bank consistently recorded Profit before Tax and Zakat of over RM 2 billion, reaching a high of RM 2.16 billion in 2014. Although 2015 and 2016 saw a slight dip in profit, the figures remain impressive given the challenging economic and market conditions then.

The bank takes great pride in having maintained a commendable financial performance amidst the backdrop of challenging and volatile domestic and global economic and geo-political conditions, waves of constant change and uncertainty, and intense competition over the past few years.

Good corporate governance has been the foundation of Bank Rakyat’s strength and success as evidenced by its strong commitment to achieve the highest standards of business integrity, professionalism and ethics in the interests of shareholders and stakeholders.

Its corporate governance model is based on stringent corporate governance practices and regulations, designed to preserve and enhance shareholders’ value through well-defined accountables, and robust internal control and risk management mechanisms.

The strategy

The bank is in the process of yet another transformation. Its comprehensive and detailed three-phase transformation programme, the first phase of which was implemented in 2013, is critical to ensure continued success and sustainability, and enhance competitiveness in an increasingly competitive environment.

Under the first phase, which ran in 2013, the bank enhanced capacity and risk management. It introduced cost management procedures, which resulted in expenses being cut by 10.17%, operational expenses reduced by 2.24%, and operational income rising by 20.61%. In the second phase, in 2015, it expanded its portfolio of products and services. In the third phase, from 2016 to 2017, the bank aims to consolidate these efforts and strengthen operations.

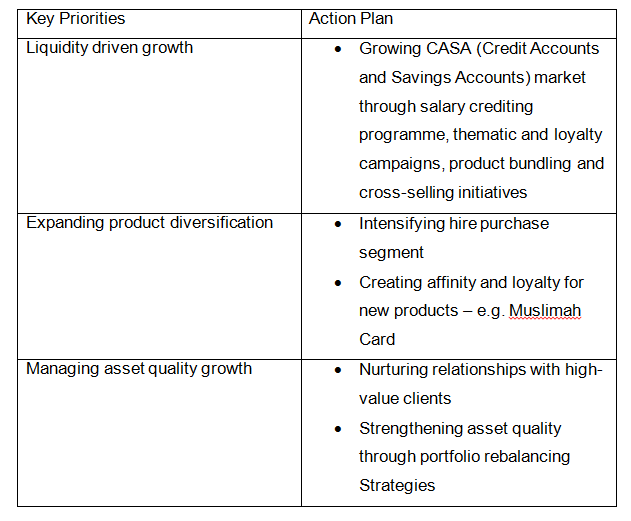

The key priorities and focus for the third phase are summarised below:

The bank has been successful in establishing a niche in the retail segment as a prime source of financing. The retail segment accounts for 90% of its portfolio and is a main contributor to revenue.

The bank has been successful in establishing a niche in the retail segment as a prime source of financing. The retail segment accounts for 90% of its portfolio and is a main contributor to revenue.

Bank Rakyat has also recorded strong growth in the personal financing, credit card, residential property financing and hire purchase segments. As for asset growth,it ranks an impressive 6th in terms of Return on Assets (ROA) among the world’s top 100 Shariah-compliant commercial banks.

New management

The bank is optimistic about sustaining growth and profitability with the vast experience of its newly-appointed top management. Tan Sri Shukry Mohd Salleh recently took over the post of Chairman and Dato’ Zulkiflee Abbas bin Abdul Hamid as Managing Director/President.

Dato’ Zulkiflee Abbas bin Abdul Hamid has over 34 years’ experience in the banking industry.

Looking ahead

With a solid foundation and a dynamic and experienced management team, the bank looksforward to delivering continued growth and profitability. Itis confident of having the expertise to deepen customer relationships, deliver more innovative products and services, benefit from growth opportunities and support consistent performance over the long term. Its business model positions the bank well to deliver superior returns and earnings stability through the business cycle.

To stay successful, the bank will build not just some core competencies,but also ability of strategic flexibility, the ability to be adept at change, the ability to challenge its past and to challenge its core competencies. The question before the bank is: ‘What is it that we should carry forward into the future, and what is it that we should leave behind?’

The bank looks ahead, not behind. And, Bank Rakyat looks forward to maintaining its position as the strongest Islamic cooperative financial institution in the world.