The well-known hedge fund manager Renaissance Technologies was established in 1982. RenTech, as it is more widely known, became well-known for using complex quantitative trading strategies, especially in the domains of algorithmic and high-frequency trading.

RenTech is a successful investment approach because it uses computer algorithms and mathematical models to analyse large amounts of data quickly, in contrast to traditional investment methods that mainly rely on human intuition and subjective analysis.

Renaissance Technologies’ proprietary trading system, which uses sophisticated mathematical and statistical methods to spot patterns and trends in financial markets, is the foundation of the company’s methodology.

With the help of this system, which Simons and his group of computer scientists, physicists, and mathematicians created, the company is able to make data-driven investment decisions remarkably quickly and accurately.

RenTech’s algorithms are made to take advantage of pricing inefficiencies in the market and quick opportunities, frequently functioning on a scale and timescale that is undetectable to human traders.

The company places a strong focus on empirical analysis and quantitative research when making investment decisions. RenTech researchers stay ahead of the curve by utilising state-of-the-art developments in computational finance, machine learning, and mathematics to continuously improve and enhance their models.

Renaissance Technologies’ reputation as one of the most successful and significant hedge funds in the world has been cemented by its unwavering pursuit of innovation, which has allowed it to consistently generate strong returns for its investors.

Renaissance Technologies has an unmatched track record, but it is infamously opaque about its internal operations and trading tactics. The company rarely shares information about its algorithms or the precise processes that inform its investment choices, preferring to keep its operations under wraps.

This shroud of secrecy has only contributed to the intrigue and conjecture surrounding RenTech, heightening its appeal and allure in the financial sector.

Moreover, Renaissance Technologies is evidence of how technology can revolutionise the financial industry. Through the development of quantitative trading strategies and the pursuit of mathematical innovation, the company has completely changed the face of contemporary investing and established a bar for excellence that few can match.

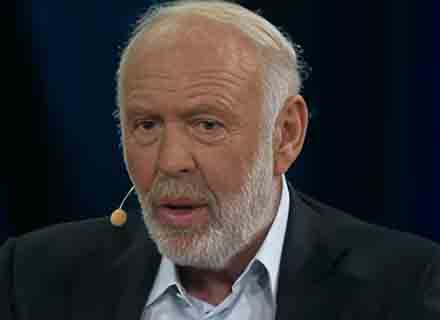

The brain behind this successful venture is 85-year-old mathematician and former codebreaker James Simons. He is the founder of the company.

-

Who Is James Simons?

- James Simons was born on April 25, 1938 to an American Jewish family

- In 1958, he received a bachelor’s degree in mathematics from MIT, and a PhD in mathematics from Berkeley under the supervision of Bertram Kostant in 1961 at the age of 23

- In his early life, James Simons began to work with Shing-Shen Chern on the theory of characteristic classes, eventually discovering the Chern–Simons secondary characteristic classes of three-manifolds

- He was elected to the US National Academy of Sciences in 2014

- James Simons worked with the National Security Agency to break codes in 1964

- He was among the research staff of the Communications Research Division of the Institute for Defence Analysis (CRD of IDA) and taught mathematics at the Massachusetts Institute of Technology and Harvard University, between 1964 and 1968

- From 1968 to 1978, James Simons served as chair of the math department at Stony Brook University

- In 2006, he was named Financial Engineer of the Year by the International Association of Financial Engineers

- In 2004, James Simons founded Math for America with an initial pledge of USD 25 million from the Simons Foundation, a pledge he later doubled in 2006

- As reported by the Bloomberg Billionaires Index in 2023, James Simons’ net worth is estimated to be USD 29.4 billion, making him the 52nd-richest person in the world

James Simons: The Biggest Donor

James Simons and his wife Marilyn hit the headlines in January 2024, by featuring in the Chronicle of Philanthropy’s annual list of 2023’s biggest donors. The couple donated USD 500 million to the State University of New York at Stony Brook.

Simons earlier taught and chaired the mathematics department at Stony Brook, thereby sharing a deep connection with the institution. Marilyn Simons earned her bachelor’s degree and a Ph.D. in economics from the same educational institute.

The couple came second to the “Oracle of Omaha” Warren Buffett, the legendary American businessman who emerged as the foremost philanthropist in the United States, according to the Chronicle of Philanthropy. He donated approximately USD 541.5 in Berkshire Hathaway stock to the Susan Thompson Buffett Foundation in honour of his first wife.

The Simons couple was followed by Nike co-founder Phil Knight and wife, Penny, who gave USD 400 million to the “1803 Fund”, aiming to rejuvenate Albina, a historically Black neighbourhood in Portland, Oregon, devastated in the 1970s.