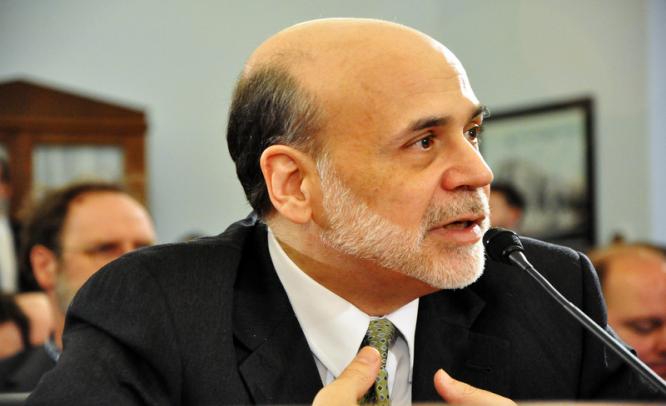

The decision and economic projections are out at 1800 GMT while Fed Chairman Ben Bernanke will start his press conference half an hour later

19th September 2013

Today’s Federal Open Market Committee meeting will be seen with huge interests by investors, financial markets, currency strategists and commodity traders as the world’s most powerful central bank is widely expected to unwind its bond buying program. The Federal Reserve is expected to taper its USD 85 billion dollar, Q.E – a decision which will be taken in the FOMC meeting today, the decision and economic projections are out at 1800 GMT while Fed Chairman Ben Bernanke will start his press conference half an hour later. The central bank is projected to trim its monthly spending on QE asset purchases by $ 10 billion, conversely, it is reported by sections of the media that the FOMC may, for a third consecutive time, lower growth forecasts for 2013, because inflation is still half a percentage point below the Fed’s target and though unemployment lowered at 7.3 percent it has not reached the Fed’s target of 6.5 percent.

Why Tapering ?

The announcement by Bernanke to taper the bond purchase comes after the world’s biggest economy staged a recovery with inflation and unemployment close the government estimates, other reasons include the recovery of Eurozone from recession and improved manufacturing activity.

How have markets responded?

When Mr. Bernanke announced on June 20th of a possible tapering of U.S bond buying the markets tumbled with the Australian dollar plunging by three cents within a few seconds of the announcement. It’s a clear example of the roller coaster ride that financial markets have been on since Mr. Bernanke started to signal the start of a tapering process. It also explains the power wielded by Fed Chief’s, this is not a new phenomenon as Former Fed Chairman Alan Greenspan was nicknamed the “Oracle” for the way markets used to react on his statements.

Yields on 10 year treasury notes were lower at 2.84 percent on Wednesday, that is up from 1.62 percent back in May before the Fed first raised the spectre of tapering. For commodities a dovish move by the Fed would more supportive for prices. Copper futures were 0.5 percent firmer at $ 7, 109.75 on Wednesday, though still down 11 percent for the year so far. Spot gold eased back to $ 1,297.89 in anticipation of Fed’s decision to unwind its easy money policy.

International Finance Magazine had reported in detail about the Implications of Quantitative easing to Emerging Markets in an article dated 2nd September 2013, and explaining the significance of “tapering” on world markets in its article dated 22nd August 2013.

“Spillover Effect” on Emerging Markets

The credit easing measures of U.S. Federal Reserve will have a spill over effect globally and hurting the emerging markets in particular. The announcement has triggered a selloff in emerging market currencies, stocks, bonds and a flight of capital to the U.S. The emerging markets have seen an exodus of cash, with their 20 most traded currencies falling by more than 5 percent. India in particular is the hardest hit with international investors withdrawing nearly $ 12bn from India’s markets since the beginning of June, resulting in the fall of Rupee to record extents.

The decision and economic projections will be out at 1800 GMT along with the penultimate press conference by outgoing Fed Chairman Ben Bernanke, markets world wide can react violently based on the decisions taken in FOMC meeting but completely reverse course depending on what Bernanke says.