A Thailand based Thai Life Insurance Public Company Limited (TLI) is focusing on the importance of building strength and sustainability for themselves and Thai society. It is the first life insurance company that established a CSR Strategic master plan since 2008 in collaboration with Thaipat Institute, to be used to drive CSR operations for over 10 years.

Until 2019, Thai Life Insurance is also the first life insurance company to establish a Sustainable Development Master Plan to lead the organization’s operations in response to changing factors and circumstances as well as ensuring that the various departments have a framework for sustainable development that is strategically linked by focusing on social responsibility in the business process (CSR-In Process) and the concept of Creating Shared Value (CSV), which leads to sustainable development for both the organization and society.

The situation has changed greatly after the COVID-19 pandemic which has affected the lifestyle of Thai people. Thai Life Insurance has adjusted its business processes to be ready for the change (Resilience) and announced its vision. “To be a Sustainability Life Insurance company” and set a business purpose in accordance with the vision “Aim to be all the answer of life insurance, health insurance and personal financial planning” or Life Solutions Provider, including determining the Brand Purpose to be a brand that is gain loved, trust and is a brand that inspires people in society.

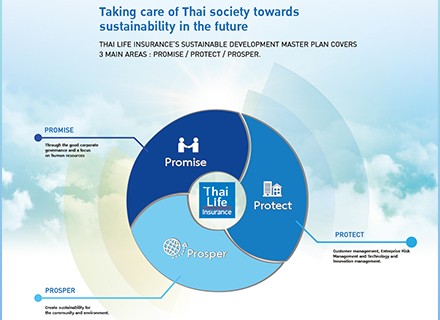

At the same time, Thai Life Insurance has reviewed and formulated a three-year Sustainability Development Master Plan (Years 2022-2024) to be in line with business operations in the New Normal era and in accordance with the Company’s future business directions, consisting of: The three-P strategy as following:

1. Promise

Upholding promises to all stakeholders (Stakeholders), particularly consumers. with management adhering to good corporate governance and managing employees in a professional and ethical manner.

2. Protect

It is a customer-centric strategy through product development and responsible service. and can meet the needs of customers individually (Personalize) and focuses on managing risks that may occur both directly and indirectly. Customer sustainability includes the responsible management of customer data and information technology systems.

3. Prosper

Creating a flourishing boom. Focusing on economic growth while contributing to the creation of society and the environment. both community and social management in a sustainable manner, as well as environmental management.

To ensure sustainability performance is in line with the current situation, the company has defined sustainability targets in accordance with the ESG principles, including Environment. focuses on risk management and the impacts of climate change. to ensure continuity of business operations does not have an impact on the stakeholders, whether it is the establishment of a risk management committee, developing business continuity and disaster management plans including environmental management through the initiation of various projects that reduce the environmental impact of the company’s business operations, such as replacing the digital system to reduce the use of resources, energy consumption or waste.

Social, concerned with human resource management Thai Life Insurance conducts operations in accordance with humanist values. Personnel is considered an asset and the most essential capital. Committed to developing employees to be both smart and good people who can stand alongside customers and society. Manage people with regard for human rights, equality, safety, and fair treatment in line with the Company’s regulations and laws, and in accordance with the corporate values and culture that believe that cooperation and dedication are the keys to mutual success.

Thai Life Insurance focuses on Upskill and Reskill, including adjusting the Mindset of personnel to have the knowledge, Understanding Data (Data Literacy), Understanding Digital (Digital Mindset) Agility Mindset by elevating agents to be Life Solutions Agents ready to take care of customers in every Life Stage, every Life Event and every Lifestyle.

In addition, Thai Life Insurance also attaches great importance to customer care. through the products and services development that meet all needs and create opportunities for Thai people to have easier access to life insurance and more convenient by laying out guidelines to drive the organization with data in the form of a Data Driven Company. come to support the work in order to create innovations that can meet the needs of customers (Innovation for Customer) and create Innovation for Organization.

Not only that, Thai Life Insurance also focuses on community and social management for sustainability through upgrading the quality of life and enhancing insurance knowledge, for example, initiating the Thai Life Insurance- Opportunity for Better Life, which is aiming to promote all-round potential for community enterprises across the country.

Governance

Thai Life Insurance operates its business with good corporate governance, with systematic monitoring of its performance and instilling in personnel with a Code of Conduct such as anti-corruption, compliance with laws on social and economic matters, etc., while also realizing the Market Conduct, whether it is responsible management of customer data to ensure that the company’s products and services presentation is complete, transparent, and has strong personal data security of customers.

As a financial institution, Thai Life Insurance therefore places a great importance on good governance. Specifically, the treatment of customers with transparency and fairness, as well as maintaining information security, followed by social. Because life insurance is a business that involves people and communities. But we do not forget to take care of the environment as well.

In addition, Thai Life Insurance is also operating a sustainable investment policy in the form of ESG Investing, which is an investment in equity securities that consider three-R factors, i.e. risk, return, and the impact that companies have on society or the environment (Real Impact) by allocating funds for investments in listed companies with outstanding performance in environment, society and good governance.

The business’s operation both in terms of initiating and improving will integrate with the governance, social and environmental factors which play an important role in creating value for both the company and the stakeholders, which is an important role in driving the company to strong and sustainable growth consists of six values. These are as follows:

1. Creating value for customers, is a life insurance company that customers love.

2. Creating value for people in the organization, is an organization that cares about the employees.

3. Creates value for partners, is a life insurance company that partners choose.

4. Creating value for shareholders, is an organization that provides a sustainable return on investment.

5. Creating value for society, is a responsible organization and to improve the quality of life.

6. Create value for regulators, is an organization that operates business in a strict manner. to lead to sustainable development together.