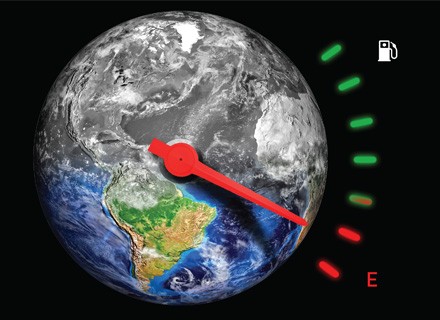

The world is still recovering from the coronavirus pandemic and we are now facing a new challenge- an energy crisis. What we are witnessing is a supply crunch for natural gas, coal and other energy sources in different parts of the world. Natural gas prices soared in Europe this year, while fuel pumps in the UK went dry causing panic among the masses. In China, several factories had to shut down operations due to power disruptions caused by a shortage of coal supply. Many in India too raised concerns that the country’s power plants were running on critically low coal stocks.

Natural gas prices in Europe have soared by over 400 percent since the beginning of the year. Electricity prices have also increased by over 250 percent during the same period. Meanwhile, in the US natural gas price has more than doubled. Natural gas is mostly used for electricity and to generate heat in the UK during the winter season. Furthermore, the price of coal in the US has soared by nearly 400 percent this year to reach $270 per ton. The crisis is as we understand is considerably worse in Europe. Electricity prices in the continent have soared significantly as well. Natural gas prices have surged as well to $30/mm Btu.

This is resulting in inflation which means prices for energy-intensive metals are also increasing. For example, prices of metals such as nickel, steel, silicon have increased due to the energy crisis. Besides metals, prices of fertilizers have ramped past 2008 record highs to nearly $1,000 a ton. It is noteworthy that the prices were around the $300 to $450/ton mark in the last couple of years. The price for copper too has increased to a record high of $4.50 per pound. Copper is an important metal and raw material for the solar or wind energy industry, which emphasis is growing day by day as and is seen as an important factor to tackle climate change.

In Britain, renewable power production this year was much lower than normal as a result of a windless summer. The region meets around 24 percent of its energy needs through the wind. However, due to low production this year, it means the UK has to rely on coal. Over the years, Britain has transitioned away from coal as an electricity source. Prime Minister Boris Johnson said that the UK remains committed to wind power generation. He went on to say that he wants the UK to become the ‘Saudi Arabia of wind power’ with offshore wind farms generating enough electricity to power every home in the UK in the next 10 years.

However, the landscape is pretty different in the present time. Soaring electricity prices is a matter of growing concern for politicians across Europe. The crunch in the gas market is forcing countries to revert to coal. This goes against Europe’s fight against climate change and that the fact that the UK hosted the 2021 United Nations Climate Change Conference, more commonly referred to as COP26 at the SEC Centre in Glasgow.

In Asia, thermal coal prices also keep hitting record highs. In short, there isn’t enough coal to meet demand. Economies in the region are slowly resuming activities and are in the process of an economic revival, be it China, Malaysia or India. It has led to greater demand and is one of the primary causes of an emerging electricity crisis in China. Coal stockpiles are running low in India too, however, the government claimed there are enough stockpiles to keep the wheels running.

The International Energy Agency said in a report, “Record coal and gas prices, as well as rolling blackouts, are prompting the power sector and energy-intensive industries to turn to oil to keep the lights on and operations humming. Higher energy prices are also adding to inflationary pressures that, along with power outages, could lead to lower industrial activity and a slowdown in the economic recovery.”

The agency further added that global energy demand is set to increase by 4.6 percent in 2021. This will be led by emerging markets and developing economies – pushing it above its 2019 level. Demand for all fossil fuels is on course to grow significantly in 2021, with both coal and gas set to rise above their 2019 levels.

Europe’s energy crisis

Even though there isn’t a simple answer to this, a natural gas supply shortage in the region caused the energy crisis in Europe. But why is there a shortage in the supply of natural gas? There are many factors that are also contributing to the crisis. To understand this crisis better, we must understand that nations across the globe are pledging to reduce emissions and become carbon neutral in the next few decades. Reduction in the usage of coal is an important factor when it comes to tackling climate change. As nations are transitioning away from coal, they are meeting their energy demands with other sources such as natural gas or renewable energy sources. According to the bloc’s statistical office, Eurostat, the EU imported around 90 percent of its natural gas from outside the bloc in 2019.

As a result of the pandemic, the whole world entered into a state of lockdown and global energy demand fell significantly. This led to a drop in natural gas prices. With the Covid-19 vaccination drive ongoing, nations are resuming economic activities and as a result, energy demand has also increased significantly. However, supply has struggled to keep pace.

Given natural gas prices are higher in Asia, it is quite normal for producers to prioritise Asian markets over Europe. This is normally not problematic for Egypt, however, since the demand for natural gas in Asia began skyrocketing this year, supply has become extremely constrained. Normally, what Europe does is stockpile gas reserves when prices are low. But this year, it was not possible due to constrained supply. With the winter seasons approaching, people in Europe are rightfully concerned over their low gas supply.

The pandemic has also made matters complicated or in short, have played a part in the crisis. Due to the lockdown measures and other Covid-19 related restrictions, the production of coal in countries such as Indonesia, Australia, and India have taken a hit. This has forced countries in Asia to rely even more on natural gas to meet their energy needs further reducing the available supply for Europe.

To fully understand the energy crisis, we must also understand the role of Russia. As per reports, Russia supplies about 50 percent of the EU’s natural gas imports. Many Russian gas pipelines do flow into Europe through Poland and Ukraine, but most of them have been inactive. As the energy crisis deepens, many pointed the finger towards Russia and blamed the country for being an opportunist and benefitting from the crisis.

This is because Russia is pushing for German approval of its Nord Stream 2 pipeline. Also, Russia is hesitant to sell Russian gas on the spot market. Russia’s state-owned energy giant Gazprom has been accused by the likes of the International Energy Agency (IEA) and European lawmakers of purposely not boosting its natural gas supply to Europe. In a statement, the IEA said, “The IEA believes that Russia could do more to increase gas availability to Europe and ensure storage is filled to adequate levels in preparation for the coming winter heating season.”

Global energy crisis

The energy crisis is not just limited to Europe at this moment. In China, energy prices are soaring because of increasing consumer demand as economic activities return to normal after the pandemic. Production to meet the increasing demand, however, has failed to bounce back. This has led to a supply and demand imbalance. Similarly, in the UK, a shortage of truck drivers who ferry fuel to pumps has led to the fuel crisis. The shortage is attributed to Brexit and also restrictions imposed due to the pandemic.

Many also believe the rise in energy prices is a result of increasing restrictions announced by governments on traditional energy sources such as coal. In their bid to tackle climate change, regulators across the globe are discouraging the use of traditional energy sources and simultaneously encouraging the use of renewable energy. China, which is one of the biggest polluters, pledged to reduce emissions by 65 percent by the end of 2030 and has cracked down heavily on coal mining.

The UK generates around 24 percent of its energy needs from wind. However, due to low production this year, it means the UK has to rely on coal. Many also argue that shifting focus too quickly on renewable energy is also a reason for the energy crisis. What we need is a proper transition from traditional sources to renewable energy. An aggressive push may have led investors to under-invest in traditional energy sources. A report released by Rystad Energy supports this. The report revealed that investments in traditional sources by European or US-based oil companies shrunk by more than half between 2015 and 2021.

What lies ahead?

Europe’s energy crunch is expected to further worsen as the northern hemisphere winter approaches. With natural gas prices skyrocketing, many fear the EU’s integrated energy system could be on the verge of breakdown. To sustain the winter, many member nations are already resorting to hoarding what supplies they have. This only adds to the trouble as it provides a platform for an intra-EU political squabble.

As of now, it looks like energy supplies are likely to remain constrained. Boosting production in a short period of time is not easy. Also, the rise in prices is not helping either. In fact, the crunch is expected to worsen depending on the weather conditions. A much severe winter means higher energy demand. It will be interesting to see how the EU and leaders across the continent respond to the crisis.

While there are calls for measures to control prices, it can only make matter worse. Even if regulators do introduce measures to control prices for natural gas, it will discourage producers who will think twice before deciding to boost production. While a limited supply means energy must be used efficiently, a price cap could potentially lead to consumers overusing energy and only adding to the crisis. A lot of Chinese thermal plants are shutting down because of the introduction of measures to control prices.

During the winter, energy sources such as solar or wind energy often turn out to be unreliable, especially in Europe. With prices of natural gas increasing, Europe may be forced to rely on traditional fossil fuels. This means governments across Europe will have to rethink their energy policy.

The IEA’s Global Energy Review 2021 estimates that CO2 emissions will increase by almost 5 percent this year to 33 billion tonnes, based on the latest national data from around the world as well as real-time analysis of economic growth trends and new energy projects that are set to come online. The key driver is coal demand, which is set to grow by 4.5 percent, surpassing its 2019 level and approaching its all-time peak from 2014, with the electricity sector accounting for three-quarters of this increase.

Natural gas prices in Europe have soared by over 400 percent since the beginning of the year. Electricity prices have also increased by over 250 percent during the same period. In October, the UK recorded a stellar 37 percent spike in UK wholesale gas prices within a period of 24 hours. As a consequence of the rise in prices and the overall crisis, manufacturers of steel, chemical and fertilizer businesses are calling on the government for support as well.

The prices of natural gas, oil and coal have hit highs that were not seen in recent years. Coal supply disruption in China has also led to factories being shut down. This has halted the country’s recovery from the Covid-19 pandemic, which started in Wuhan in late 2019. Energy prices do affect economic decisions across the supply chain. Furthermore, soaring energy prices have had a significant impact on economic policies. Many European, as well as Asian companies, are shutting down operations due to increasing energy costs.

The IEA said that global energy demand is set to increase by 4.6 percent in 2021. This will be led by emerging markets and developing economies – pushing it above its 2019 level. Demand for all fossil fuels is on course to grow significantly in 2021, with both coal and gas set to rise above their 2019 levels. Oil is also rebounding strongly but is expected to stay below its 2019 peak, as the aviation sector remains under pressure.

Long winter in Europe

During the start of this year, the northern hemisphere witnessed a series of very cold and extreme weather events. If the same is repeated this year, it will put additional pressure on the energy stock which is already depleted and stretched severely. Chartering ships to transport LNG has also taken a hit due to a lack of shipping capacity. Daily spot LNG vessel charter rates have spiked above $100,000 in each of the last three northern hemisphere winters and hit an all-time high of well above $200,000 during the unexpected cold spell in northeast Asia in January 2021 – amid physical shortages of available shipping capacity, according to the IEA.

Governments are doing their bid to deal with the crisis. For instance, the Italian government has announced a €3.4 billion budget to support low-income households in the country. Italy has suspended grid charges for private residents and has promised to further subsidise electricity costs. In France, the French government has decided to let gas prices rise by 12.6 percent before freezing prices at least till the end of April. The government is handing out energy vouchers to the vulnerable to help them deal with the energy crisis. The Spanish government has decided to suspend supply cuts in the country for vulnerable residents until 2023.