Accelerate Property Fund (APF), a well-known real estate investment trust, is negotiating to sell Portside Tower and four additional buildings in an effort to lower its debt and alleviate financial pressure.

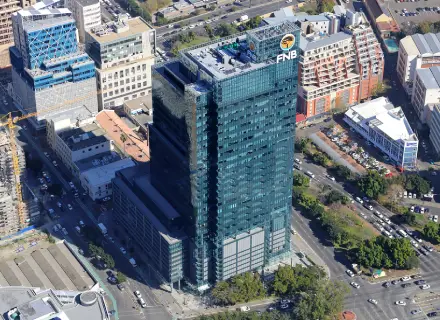

The South African city’s tallest structure, Portside Tower, is situated in Cape Town’s central business district and is anticipated to sell for a little over R600 million. It has 30 floors and is 136 metres tall, with FNB as its anchor tenant.

This famous building, which has a five-star rating from the Green Building Council of South Africa, has about 50,000 m² of office space. Different office sizes are available in the building. A balcony on the tenth floor overlooks the Atlantic Foreshore and Table Mountain. In addition, the facility has a wellness centre and a well-equipped staff cafe.

The Oceana Group’s headquarters on the Foreshore and the adjacent Thomas Pattullo building are among the other Cape Town properties that Accelerate Property Fund is selling. APF’s interim results for the six months ending September 30th, which were released the day before Christmas Eve, did not include the asset valuations.

The company is also selling The Buzz Shopping Centre and the nearby Waterford Centre in Fourways, Johannesburg, with an estimated R215 million in sales profits.

It is estimated that the sale of these assets alone, less the sales of the Thomas Pattullo building and the main office of the Oceana Group, will generate about R985 million. However, it’s crucial to remember that Accelerate has increased the amount by R153 million by revising the fair value of the five properties it is selling. This suggests that Accelerate has placed a higher value on these assets than their current market value.

APF has not yet revealed the identities of the potential buyers or the specific terms of the transaction.

As of September 2024, APF’s net debt was R3.7 billion. While certain notes from the JSE’s domestic medium-term note (DMTN) programme expire at the end of February, the majority of this debt (R3.3 billion) is scheduled to mature on March 31, 2025.

The DMTN programme is responsible for R1.8 billion of the debt, with Rand Merchant Bank (a division of FirstRand) owing an extra R1.2 billion. According to the fund, talks are already in progress to renew these facilities and provide them an additional term.

Only five of the company’s top ten properties will remain after these sales: the Citibank headquarters in Sandton, Cedar Square, BMW Fourways, Bosveld Mall in Bela-Bela, and Fourways Mall.