Some tips by Robin L. Wiessmann, Secretary of Banking and Securities, Pennsylvania

January 5, 2017: With Americans paying more than $11 billion in overdraft checking fees in 2016, Secretary of Banking and Securities Robin L. Wiessmann is advising consumers on ways they can save money and avoid overdraft fees, which can cost $20-$45 per transaction.

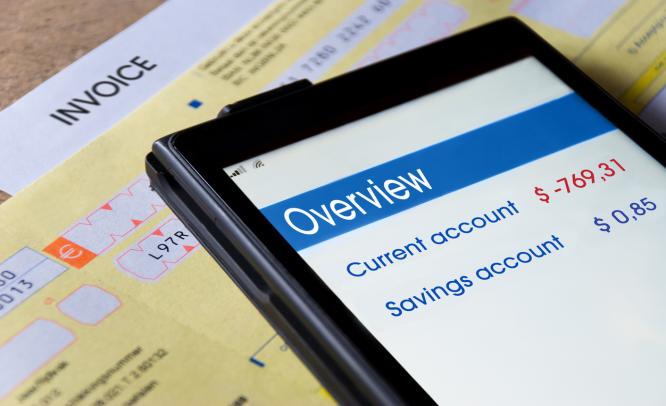

“An overdraft is when the amount of money in your bank or credit union checking account goes below zero,” said Secretary Wiessmann, who provides overall leadership to the Department of Banking and Securities in Pennsylvania, USA. “With the introduction of debit cards, automatic payment plans and other tools, personal finance has become more convenient, but also more complicated. However, following simple, common-sense rules can help keep more money in your checking account.”

Wiessmann’s top five tips to avoid overdraft fees:

- Sign up for automatic funds transfer: Instruct your bank or credit union to automatically transfer money from your savings or other accounts to your checking account to cover any shortages. Note: you may have to pay a fee for this service.

- Sign up for low-balance notices: Sign up for text or email notices from your bank or credit union if your checking account balance drops below a certain amount.

- Make sure funds are available: Make sure deposits into your checking account are actually available for your use before you spend that money. Note: review your bank or credit union’s ‘funds availability’ policy.

- Take advantage of technology: Frequently check your account balances online, by phone, or nearby ATM machine.

- Check all transactions on your statements: Carefully review your monthly account statements, looking for fraudulent transactions as well as taking into account any checks written and deposits made that may not appear until next month’s statement.

“Frequent overdrafts can also cost consumers more than money,” Wiessmann said. “You could lose your checking account and have trouble opening checking accounts in the future.”