Ireland-based Fonoa calls itself a one-stop shop for corporate taxes. Its specialisation lies in automating taxation processes for e-commerce businesses with API help.

The Dublin-based venture, established in 2018, has close to 160 employees as of September 2023, with a total funding of USD 85 million. Fonoa is reportedly the first global tax automation platform that allows its client businesses to validate tax IDs, calculate taxes, generate invoices and e-invoices, report transactions and file tax returns through a single solution.

In today’s episode of ‘Start-up of the Week’, International Finance will talk about Fonoa, which is serving companies like Zoom, Uber, NetFlix and Booking.com.

Handling 21st Century Tax Challenges With Ease

Businesses in the 21st century constantly face headaches like ever-changing tax rules, no standardised government/vendor connections for digital reporting and e-invoicing and ‘multiple sources of truth for tax information’. Fonoa combats these with its solutions, which help its clients to remain updated with the tax regulations, while having global coverage with a standard integration, along with full control and visibility through a single source of truth for all the tax data.

In short, Fonoa makes the corporate tax filing procedure a paperless, digital and hassle-free one.

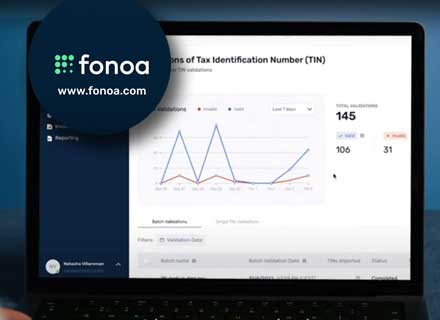

Among its solutions, ‘Global Tax ID Validation’ instantly validates Fonoa’s client business’ tax IDs in over 100 countries, in an automated manner, to ensure that these ventures are compliant with local tax regulations. By validating tax IDs, companies can file the correct amount of VAT/GST and steer clear of the penalties, apart from avoiding scenarios like unjust tax deductions and charging their customers too much or too little tax.

While businesses can directly retrieve tax IDs-related information from government sources, Fonoa also helps its client businesses to monitor and review validations from a simple, intuitive user interface, or integrate directly through its API.

Next is ‘Locally Compliant Invoicing’, where Fonoa’s client businesses can generate tax-compliant invoices and credit notes that include all required information globally, thereby avoiding operational risks like penalties, unnecessary compliance costs and frequent audits.

“Remove the need to build and maintain your own local tax templates and technology. Make it easy for your business customers to access accurate tax invoices and reclaim indirect taxes on their purchase,” the Dublin-based venture remarked.

Using Fonoa’s expertise, the client businesses can comply with country-specific invoicing rules, tax types and currency exchange needs, apart from applying specific invoice sequences, customizations, and handle promotions and discounts in line with local laws.

The businesses can also introduce unconventional formats like self-billing, third-party billing, and summary invoices, apart from using a digital signature to authenticate invoices. They can also generate invoices via Fonoa’s API, along with other methods like manual and batch invoicing from a CSV upload. Last but not least, these invoices can be customized as per currencies and over 50 languages.

Fonoa’s solutions have proved their worth in sectors like online marketplaces and e-commerce, when it comes to invoicing.

Hassle-free Tax Returns & Compliance

Fonoa helps its client businesses to automatically prepare, review and submit error-free VAT/GST returns from one single platform, thereby removing the bottlenecks like tax teams struggling with insufficient resources and relying on third-party data providers, while consuming both time and effort.

Fonoa improves tax return accuracy with automated logic and validations, while completing returns faster with central collaboration and streamlined workflows for tax return review, approval, and submission, through its collaboration with third-party service providers and tax advisors.

The tax return solution also provides real-time automated insight for its client ventures’ compliance calendar, apart from tracking the statuses related to tax returns and tax positions, drawing up simple and clean workflows for tax returns, also enabling thorough tax audits.

Along with tax returns, Fonoa’s solutions also come in handy for tax determination purposes. The Dublin-based venture helps its clients to identify the right sales tax, VAT and GST treatment of their transactions globally with a single solution that can be integrated into these businesses within 14 days.

Fonoa helps its client ventures to customize the tax rules as per their business needs, apart from eliminating the need to build and maintain their own solutions with a simple and scalable integration that has up-to-date global coverage. These businesses can also report transactions and generate real-time e-invoices with one standardized solution, while complying with the tax data-sharing laws across the nations.

A Promising Future Ahead

Fonoa founder Davor Tremac, while serving as a general manager at Uber, saw how changing tax requirements and regulations curbed the expansion of businesses in many markets.

The start-up, aimed to combat this roadblock, has emerged as the game-changing platform that has the ability to streamline and automate real-time tax workflows across the countries in one place, while helping tax managers handle their obligations in a hassle-free manner.

Fonoa’s hard work hasn’t gone unnoticed, with the venture’s fund-raising efforts being recently backed by Coatue, a Venture Capital fund started by American billionaire Philippe Laffont, who was among the first investors in TikTok’s parent company Bytedance, followed by similar investments in Snapchat and Spotify.

Fonoa, which has the feat of developing the world’s first cloud platform for the automation of tax calculations, is now nearing the status of being a ‘Unicorn’, as it aims to achieve a valuation of over USD 1 billion.