Brazil-based financial services firm XP Investimentos has hired investment banks such as JP Morgan, Goldman Sachs, and Morgan Stanley to manage its initial public offering (IPO) in the US. According to reports, XP wants to list its shares by January 2020.

Other players who are also involved in XP Investimentos’ IPO include Banco Safra, BTG Pactual, Itau Bradesco BBI, Bank of America and Bradesco BBI. The IPO is expected to raise around R$10.29 billion.

In 2017, XP Investimentos planned a similar IPO. However, the project was called off after Itau Unibanco, which is Brazil’s largest private sector bank acquired a 49.9 percent stake in XP.

Earlier in May this year, XP Investimentos again announced that its IPO has been delayed due to market instability.

Recently, the company’s fund platform reached R$100 million in custody which includes a mix of 50 percent fixed income, 40 percent multimarket funds and 10 percent equity.

Fund analyst at XP Investimentos, Jose Tibaes told the media that, “These classes have been gaining space on the platform and the capture in recent months indicate greater appetite of customers for higher value-added products.”

He further stated that the last three months the average net funding of the platform was R$4 billion.

Because of the One Account One Format in XP’s platform, a customer has the option to invest in over 400 funds from over 100 available managers from a single XP account.

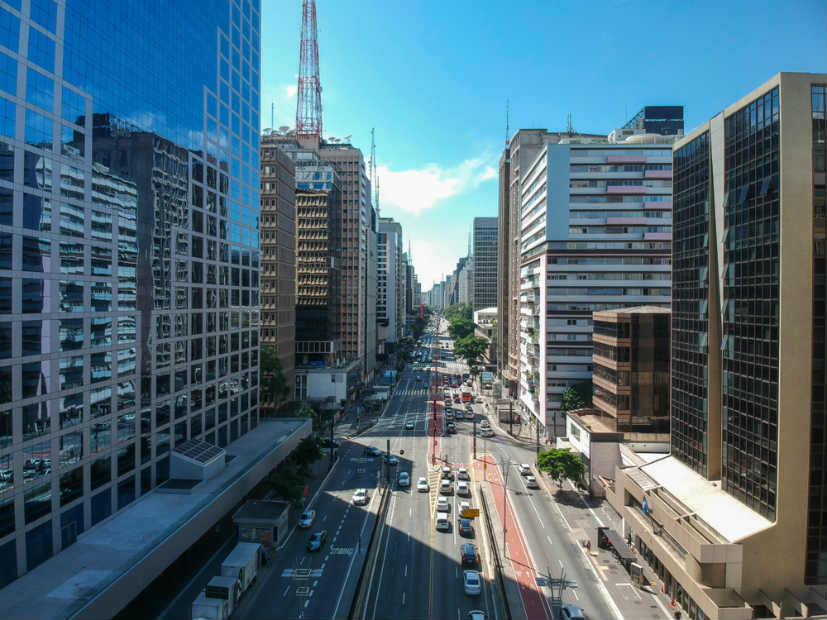

The self-regulating body of the São Paulo Stock Exchange has found XP guilty for unlawfully using its platform for its own benefits. The penalty amount is yet to be disclosed. In a response, XP said that it will meet the fine in full and also compensate its customers.