The healthtech market in China’s healthcare sector is one of the largest in the World. According to research agency, Prospective Institute, the healthtech market has reached CNY49.1 billion in value, a 46.7 percent increase from the CNY33.5 billion value it had in 2017.

According to Dr. Neil Wang, greater China president at Frost & Sullivan, this growth can be attributed to recent reforms and internet growth in the country. He told International Finance “Healthtech service is able to solve inconvenience and unfair problems of medical service. Benefiting from opportunities brought by healthcare reform in China and fast growth of internet technology, the Healthtech market in China has developed fast in recent years.”

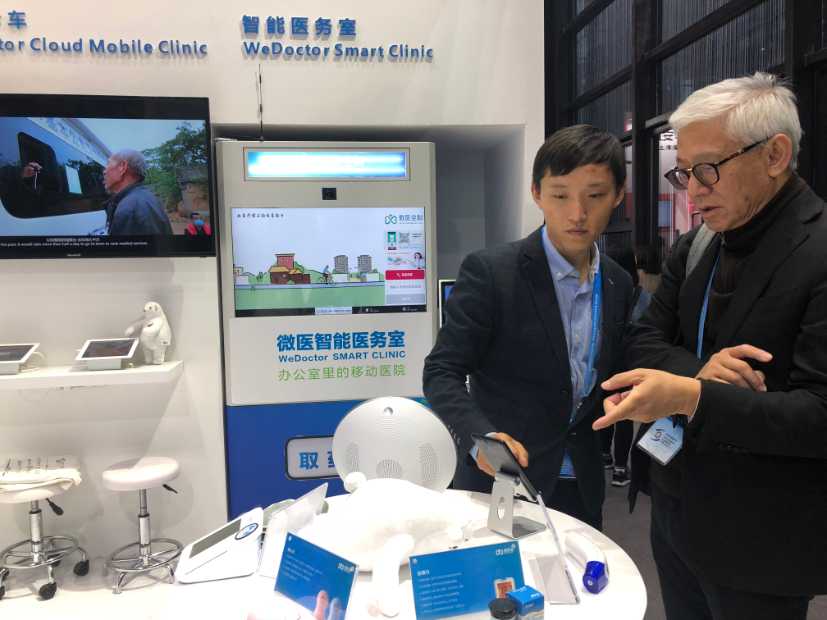

Two prominent companies according to him included WeDoctor and Ping An Good Doctor. Founded in 2010, WeDoctor provides seamless online and offline healthcare services as well as integrated of general practitioner and specialist doctor services. Meanwhile, Ping An Good Doctor, which was founded in 2014 strives to provide families with a family doctor, and each person with an ehealth profile a healthcare management plan.

These companies, he said, were helping make healthcare in China more affordable. Explaining the latter’s business model, he said, Ping An GoodDoctor lowers the spending of medical services through its specific insurance plans. “The specific insurance plans combine insurance, hospitals, and doctors. Employees who are covered by the insurance plan can visit specific medical institutions and only need to pay a little as registration fee. Under the insurance plan, patients are able to pay less out-of-pocket money.”

With regards to WeDoctor, he said, it was leveraging technology such as AI and big data along with the internet to provide solutions to both government and medical institutions. This, Dr. Wang said, helped realise reasonable allocation of medical resources on one hand and the optimisation of medical service processes on the other. “For example, Cloud Patrol Vehicle developed by WeDoctor makes quality medical service available to rural people. At present, WeDoctor is sparing no effort to create a new HMO (health maintenance organisation) model aimed at helping both patients and medical insurance funds save more money,” Dr. Wang said.

Songqi Zhang, director of public relations at WeDoctor said the biggest impact of healthtech occurs at the grass-root level and this, in turn, helps save a lot of costs which are not just medical in nature. Zhang explained to International Finance that in the past, a person living in a remote area would have to visit cities such as Beijing and Shanghai, upon falling ill, to make use of the medical services. However, now, he said, healthtech was allowing people to get treated even remotely, helping them to save a lot in accommodation and travel costs in addition to medical expenses. “.. with remote diagnosis and treatment, patients can get consultation services from well-known experts in Beijing and Shanghai at the grassroots level for just a few hundred yuan. This significantly reduces the burden of medical care for patients,” he said.

When queried by International Finance on how his company in particular was making these grass root level changes, Zhang said, for WeDoctor, there were three stages of development. The first stage, he said was the technology platform, which links hospitals and patients through a registered network. “WeDoctor established the largest appointment registration platform in China, named ‘Guahao.com’, which has been helping 2,700 hospitals to realise online appointment, online follow-up, inspection and inspection report inquiry, online payment and other functions. In March 2015, WeDoctor pioneered the expert team medical model, with more than 7,500 platform expert teams, which was later promoted by major hospitals in Beijing.”

The second stage he said was the medical platform, which connected doctors and patients through the creation of internet hospitals. Thanks to the internet, they have upgraded several village clinics at the grass-root level, which originally lacked capabilities, to efficient inspection centres and medical service centres, making it no longer difficult for rural people to meet a doctor, he said.

At the third stage, WeDoctor was using technology such as AI and big data to help grassroots doctors improve their medical capacity. In this regards, Zhang explained that his company had launched two major medical AI products – Ruiyi Intelligent Doctor and Huatuo Intelligent Doctor. While the former had achieved key breakthroughs in more than ten specialised fields such as bone age detection and general assistant diagnosis, the latter takes “TCM syndrome differentiation and treatment as the core, and condenses the experience of famous doctors into a set of TCM artificial intelligence diagnosis and treatment applications,” he said before adding that these two products were set to act as a coach to the general base doctors and family doctors.

So, while these three stages are already started making several changes at the grass-root level, Zhang said there are still some challenges to growth. These, he said, included lack of standardisation and the need for innovation and introduction of more technologies to enter the medical industry, such as genetic testing and AI medical devices.

When queried, how these challenges can be tackled, Zhang said they were doing their bit. With regards to standardisation, it had two solutions. One, is a plan to build a national training base for general practitioners and a continuing education platform for grassroots doctors and two, it had successively formulated 26 system management documents to standardise the diagnosis and treatment behaviour. It would, going forward, always insist on innovation under these policy norms. To tackle the second issue, Zhang said, WeDoctor has invested a lot of money in Centrillion Tech, the world’s leading biochip and sequencing company, to bring gene testing at the grassroots level and into the homes.

So what does the future hold? According to Dr. Wang, there were huge opportunities for healthtech companies to grow further in China and this was because of two reasons. First, he said was because the country was witnessing a growing demand for healthcare services amid an accelerating aging population and rising prevalence of chronic diseases, which offline medical institutions were unable to fully cater to. Second reason, he said was the rapid development of internet technology, making healthtech services such as online consultation and pharmaceutical e-commerce to become readily available, thus growing the scope of healthtech in the near future.

Healthtech companies in China such as WeDoctor have achieved a lot at transforming healthcare the grass-root level in China and have helped the common man not only save a lot in costs but also have made their lives more convenient. However, given the population, internet adoption, and scope for innovation, there is much more opportunity for growth for healthtech companies in China.