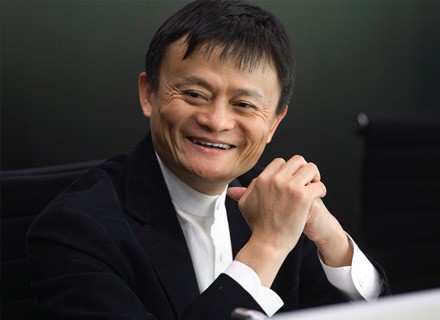

Chinese billionaire Jack Ma has experienced failures throughout his life. The 57-year-old tech business magnet once admitted, “I failed at strange stuff like a vital primary school test twice. First, I failed the middle school exam three times in a row. Later, I attempted and failed for three years of university. When KFC opened in China, I applied. 23 out of 24 applicants for the job were selected. The only person who didn’t was me. Harvard denied my application ten times.”

Jack Ma used these constant rejections to forge a stronger foundation for Alibaba Group Holding, which he co-founded in 1999. Additionally, it gave him the desire to think strategically and unconventionally, enabling him to transform Alibaba into a Chinese tech conglomerate with a market capitalization of $284.35 billion as of January 2023.

Market observers were not surprised by Jack Ma’s announcement that he would relinquish control of Ant Group, a unit of Alibaba. This action will appease Chinese authorities, who have been increasing their pressure on the corporation to reorganize its intricate organizational structure as per the requirements of the People’s Bank of China.

The business claimed it was changing its ownership structure to guarantee that “no shareholder, alone or jointly with other parties, will have control over Ant Group.” To “further enhance the stability of our corporate structure and sustainability of our long-term development,” the statement stated Jack Ma will now only control 6.2% of the voting rights.

After dealing with opposition from Chinese regulatory officials for over two years, the billionaire had debated separating the fintech from Alibaba for some time.

The situation reached a breaking point in November 2022 when officials abruptly stopped Ant Group’s first public offering (IPO), valued at over $200 billion. This was put on hold after China’s financial watchdogs cracked down on Chinese stocks listed on US exchanges.

So how did China’s most well-known and flamboyant corporate icon lose favour and end up on the government’s bad books?

A tale of rags to riches

Jack Ma, born in 1964 in Zhejiang, China, was an inquisitive child from an early age. However, when he was a teenager and eager to study English, he worked as a tour guide for foreign tourists to improve his command of the language since he believed this was a more effective method than memorizing words from a book.

Later, he attempted to enrol at Hangzhou Teachers College by taking the entrance exam but failed twice. However, Jack Ma didn’t give up, and in 1984 he was accepted into the college. He received his English degree four years later, and from then, he taught English at Hangzhou Dianzi University until 1993.

It is nearly impossible to hold a self-starter down for an extended time. So by starting Haibo Translation Agency in 1994, Jack Ma used his English proficiency to offer translation and interpreting services.

A year later, while on an official trip to the US on behalf of the city of Hangzhou, he observed Americans using the internet to fulfil most of their demands, including communication, shopping, informational needs, and entertainment.

Jack Ma came home and established China Pages in 1995, an online directory for local businesses looking for international clients, after being astounded by how technology could change lives, livelihoods, lifestyles, and the economy. Many referred to it as China’s first indigenous Internet start-up. He, however, departed it after only two years and went on to lead a government-backed Internet business until 1999.

He created Alibaba Group Holding in 1999 as a B2B website to aid in transactions between small firms when the impulse to go it alone won out. Jack Ma upset Applecart business by charging users a small cost to become verified as trustworthy vendors on the network and an additional fee for selling to consumers overseas.

When he once visited a bank, the employees refused to process an online transaction because they claimed it was a financial product. This caused the former teacher to become a technocrat, and he subsequently stated in a lecture, “If a Chinese company didn’t go into payments, some overseas company would come to do it, and we’d end up the victims. So I went to hear Clinton speak about the importance of leadership when I was at Davos. That meant doing something brave that you believe in, which won’t harm your country or your consumers. Then I had my realization, and decided to give it my all.”

As a result, Alipay began operating as a third party in online transactions in 2003. With 1.3 billion users as of 2013, it had eclipsed Paypal’s 377 million users to take the top spot among mobile payment platforms worldwide, ahead of Apple Pay’s 507 million users and Google Pay’s 421 million.

Contrary to trend

Jack Ma focused on the 2003-launched consumer-focused platform Taobao after seeing the success of Alibaba’s B2B website. Severe Acute Respiratory Syndrome (SARS) broke out in China that year, almost decimating the nation’s economy, as the government had to put lockdown to stop the spread of the disease.

His never-say-die attitude showed itself once more. Despite challenges faced by China, he and a core group of techies launched the site after finishing its development at his apartment. This decision turned the company’s fortunes around.

As more Chinese people shifted to online purchasing due to the self-imposed quarantine, Taobao established a solid foothold in the e-commerce industry. By 2006, it had surpassed eBay as the most popular e-commerce site in the nation, and by 2020, it was generating $56 billion in yearly revenue from over 600 million members.

Investors stream in

The expansion of Alibaba was not unnoticed. The year 2005 saw Yahoo investing $1 billion in the business, acquiring a 40% interest, while Softbank acquired another 30% interest. This gave the two firms a place at the table of the internet behemoth that was now well-known throughout China. Jack Ma had finally made it to the big leagues, thanks to this coalition, earning him the title of “China’s New Internet King” in the New York Times.

With the help of these favourable conditions, the e-commerce business raised $1.5 billion when it went public in 2007 on the Hong Kong stock exchange. However, the Chinese central bank published new third-party Internet payment provider regulations in 2010. It stated that these entities needed to apply for and obtain licenses from the People’s Bank of China to continue operating.

Jack Ma kept a 46% share in the financial services company and split off Alipay into a separate company. This led to a protracted dispute with Yahoo, which asserted that his decision to divide the company without informing it beforehand resulted in a sharp decline in the value of Yahoo’s stock.

Despite these developments, visionary entrepreneur-backed Alibaba applied for a $25 billion IPO in the US in 2014. However, there needed to be more clarity regarding the connection between Alibaba and Alipay, and concerns surfaced on how the parent firm would profit from the public offering.

Later, the Chinese conglomerate clarified in its revised draft prospectus that Alibaba no longer had “an ownership interest in or control over Alipay or its current parent company.” In addition, it acknowledged that Jack Ma still owned 46% of Small and Micro Financial Services firm (SMFSC), the parent firm of Alipay.

The Ant continues to march

Jack Ma gained recognition over time as the person who built a tech behemoth and the best brand representative for contemporary China. From former German Chancellor Angela Merkel to twice-elected American President Barack Obama, he embodied the nation’s significant technological advancements and economic prosperity.

The administration at home, though, was keeping a close eye on his expanding political views. Jack Ma attended the Bund Summit in October 2020, and things started going awry for him. In his address, he attacked the Chinese regulatory market, saying, “Good innovation is not afraid of regulation, but is afraid of being subjected to yesterday’s way to regulate.”

The Chinese billionaire may have been attempting to be humorous when he compared the nation to a “pawn market” and accused it of adhering to outdated business practices. But the dictatorial government was anything but amused.

Jack Ma’s comments were an outright rebuke of Chinese President Xi Jinping’s determination to end monopolistic activities to “prevent the disorderly expansion of capital.”

In retaliation, the Chinese antitrust authorities investigated Alibaba’s practice of pressuring vendors to sell exclusively through its platform. Ant Group representatives were called in for a meeting to discuss consumer rights and competition. Additionally, Alibaba found itself in the crossfire of the ongoing geopolitical verbal battle between China and the US, which has been more heated after COVID’s breakout, as US officials began closely scrutinizing Chinese businesses’ listings on their bourses.

To reach investors in mainland China for Ant Group’s initial public offering (IPO), the e-commerce giant said it would add a primary listing in Hong Kong to its New York presence. This came after the e-commerce behemoth paid a massive $2.8 billion fine due to regulatory scrutiny in China.

Jack Ma stayed out of the spotlight after the reaction from the administration and disappeared for a while. Then, according to Reuters, the Chinese financial authorities cautiously approved Ant Group’s request to resume its dual public listing in July 2022.

The man, the prophet

Jack Ma continues to be a visionary in the business realm, and players in the industry and politicians hold him in high regard despite his blunders in the political sphere.

He talked more about wanting to do more than manage a business as he met more fellow thinkers from diverse streams. He had a strong love for philanthropy and innovation, focusing on education in rural China as a nod to his earlier career as a teacher.

“In the future, there will be a competition for creativity, imagination, learning, and independent thought rather than for information. If you think like a machine, trouble will eventually arise,” Jack Ma said.

He also stated in one of his talks that after 20 years of making people more like machines, robots will resemble people in the next 20 years.

Jack Ma formally resigned from his position as Alibaba’s executive chairman in 2019. In an open statement announcing his departure, he said, “I still have many goals to pursue. Those who know me well understand that I dislike being idle. As I am still young and the world is vast, I want to experience new things.”

His decision to relinquish control of Ant Group is just another step in his departure from the vast empire he has created, leaving behind a lasting legacy.