Established in 2011 in Israel, FinYX originated as a leading proprietary trading firm with a specialised focus on High-Frequency Trading (HFT) strategies. Over the years, FinYX has undergone a significant evolution, diversifying its portfolio to encompass a wide array of financial products. Presently, their trading activities encompass derivatives (Futures & Options), equities, bonds, and beyond. Employing sophisticated techniques, their strategies cover the range from market-making to market-taking, all rigorously crafted based on proprietary, in-house predictions.

While FinYX group’s roots lie in the HFT landscape, they have consciously shifted their emphasis from being fast, to expand into the Mid-Frequency arena. Their primary focus is on crafting and refining superior predictions and algorithms. Over the years, FinYX’s trading horizons extend from seconds to several days, reflecting a comprehensive approach that prioritises accuracy, strategy sophistication, and continuous algorithmic development. FinYX is dedicated to navigating the dynamic financial landscape with a commitment to excellence and innovation.

Recently, International Finance caught up with FinYX Quants CEO Tal Teperberg and FinYX Fund Managing Director Roey Kosover, who shared insights about FinYX’s fund strategies, adapting to high market volatility, integrating AI into their business, and much more.

International Finance: Enlighten our readers about the operations of FinYX group.

Tal Teperberg: To date, the FinYX group comprises over 60 employees, with backgrounds predominantly from the fields of computer science and statistics. These skilled professionals are strategically divided into two core activities: HFT Proprietary Trading and Mid-Frequency Trading.

Notably, our trading approach is characterised by a commitment to systematic processes, employing fully automated methods without any human intervention. The configurations adopted derive from simulations that undergo rigorous development and review. Implementation is carried out by complying with stringent risk management protocols to ensure the security of our trading activities.

International Finance: What is the structure of your fund?

Roey Kosover: FinYX Fund operates as a Segregated Portfolio Company (SPC) within the framework of a Cayman umbrella-like structure. Within this SPC structure, distinct Segregated Portfolios (SPs) function autonomously, isolating assets and liabilities. Presently, our portfolio encompasses two SPs dedicated to specific trading strategies: Intraday Strategy and Multiday Strategy. Each SP operates independently, optimising focus and resource allocation.

Additionally, FinYX extends its services to a managed accounts solution exclusively for large institutional investors.

International Finance: Can you tell us about your fund strategies?

Tal Teperberg: Let’s look into our Mid-Frequency Trading (MFT) activity, where we effectively manage external funds through two distinct products: Intraday Strategy and Multiday Strategy.

These strategies are carefully crafted to be entirely dissimilar on multiple fronts. Firstly, the algorithms employed in each are distinct, drawing from disparate data sources and particularly featuring unique core algorithms. Secondly, the trading horizons diverge significantly, with the Intraday Strategy operating on a scale of hours, while the Multiday Strategy extends its prediction for a few days. This intentional design ensures a minimal correlation between the two, enhancing the diversification of our overall portfolio. Although having different algorithms, both strategies have been providing double digit average net return in the last few years.

The Multiday Strategy, launched in July 2022 is characterised as a mid to low-frequency approach, and involves a multi-signal strategy exclusive to US markets. Focused on the largest liquid index equity futures and sectorial ETFs, the strategy currently incorporates signals from different sources, minimising correlation among them. The fund portfolio currently allocates ~50% of the Assets Under Management (AUM) to index equity futures (NASDAQ, S&P, DOW, and Russell) and the remaining 50% to several US sectorial ETFs. The ETF trading component employs a relative-value strategy, maintaining a balanced position with nearly zero net exposure.

The Intraday Strategy, initiated in 2018 and managing external funds since April 2019, adopts a mid-frequency momentum-based approach. Primarily trading global equity index futures, with a focus on the US and Hong Kong markets, this strategy holds positions for a few hours, ensuring all positions are closed by the end of the day to avoid overnight exposure. Typically, the intraday leverage ranges between 0-2 times leverage, providing a balanced and controlled approach to risk management.

From an exposure perspective, the strategy uses intraday leverage that can reach rarely up to x4.5 gross exposure.

International Finance: Why would an investor want to invest with you?

Tal Teperberg: FinYX brings over extensive trading experience in global markets, boasting a proven track record that attests to our proficiency. Our diversified team, characterised by its inventive and unique approach, continuously crafts trading strategies that stand out.

In our pursuit of excellence, we prioritise sustainable and scalable algorithms designed for generating substantial Alpha over an extended period. To maintain this standard, we only introduce strategies above 2 Sharpe ratio in simulations.

Facilitated by a robust and sophisticated simulation environment, we subject our strategies to careful testing using multiple years of historical data. The data integrated into our systems is of the highest quality, accurately validated and cross-checked to ensure accuracy and reliability.

Post-implementation, our vigilant monitoring and comparison practices come into play. Continuous simulations and comparisons of live returns against simulations are conducted to identify and rectify any deviations promptly.

Roey Kosover: As systematic short-term traders, we follow a non-discretionary approach. The strategies are designed to perform uninterrupted in all market conditions, be it a bullish or bearish environment. Both strategies maintain a balanced split between long and short signals most of the time, without any bias towards the market direction. This commitment to precision and adaptability underscores FinYX’s dedication to excellence in systematic trading.

Our award-winning strategies can be found in several leading databases and are available to be purchased in the leading banks.

International Finance: Can you share about your targeted investor base?

Roey Kosover: Our focus is exclusively on professional and qualified investors. Within the fund, our primary targets include family offices, funds of funds, and High Net Worth Individuals (HNWI). Operating as a boutique asset management firm, we set a minimum investment threshold of at least $0.25 million for each investor in the fund.

In managed accounts, our target audience extends to institutional investors capable of allocating significant amounts to our strategies. This approach allows us to engage with investors who understand the uniqueness of our methodology and can leverage the benefits of a managed account structure.

For transparency and accessibility, our fund’s returns are available through leading hedge fund databases. This commitment to clarity and accountability highlights our dedication to facilitating trust and transparency with our valued investors.

International Finance: What is your investment philosophy and how does it align with our hedge fund’s strategy?

Roey Kosover: Being a systematic-based company, our investment philosophy is firmly rooted in relying on configurations derived from simulations. While data is the foundation of our wealth, we acknowledge its inherent nature as statistics, recognising that unforeseen variables can go beyond what we expected. Thus, we emphasise the importance of implementing a rigorous risk management system—operating with precision and vigilance to navigate the dynamic landscape of financial markets.

International Finance: Can you share thoughts about your approach to risk management?

Roey Kosover: Our top priority is managing risk in our operations. Since we rely on automated trading rather than manual intervention, our primary concern revolves around potential system malfunctions.

To address this risk comprehensively, we employ a three-tiered risk management approach. The initial layer involves an in-house risk engine meticulously scrutinising each order before it reaches the market. Examining over 20 parameters, including price, size, and rate, any deviations beyond predefined limits prompt the system to automatically pause and cancel all active orders.

Furthermore, we’ve implemented a real-time monitoring mechanism for assessing our position exposures in the markets. This mechanism issues alerts or initiates closures when predefined risk thresholds are approached.

The second layer integrates the broker’s risk engine into our risk management framework. Despite not being overly sensitive to latency, we leverage the broker’s risk engine for an additional layer of scrutiny.

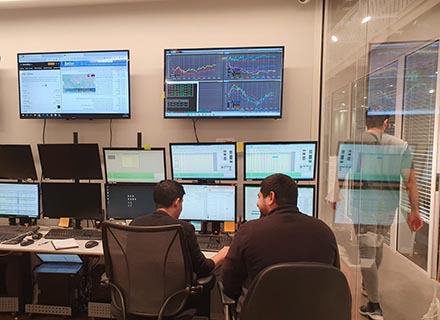

The third layer introduces a human element—our vigilant trading system operators. They continuously monitor the system throughout all trading hours, ensuring uninterrupted functionality. In the event of any malfunction, the operators step in, closing positions and minimising risks.

From an infrastructure standpoint, we’ve fortified ourselves against various contingencies. With multiple hosted servers across different sites, dual connectivity lines for market data and execution, and even two internet providers in our office, we’ve created a resilient setup. This ensures the systems can operate under any market condition without interruption due to technical issues.

The infrastructure design aims to enable continuous trading, regardless of market conditions, while mitigating technical and operational risks. Other risks, such as interest rates, currency fluctuations, and liquidity concerns, are considered less relevant given our focus on short-term trading in highly liquid products.

International Finance: How are the returns adapting to high market volatility? Also, how do you handle periods of underperformance in your portfolio?

Tal Teperberg: Our core strategies are built around momentum. We actively seek market volatility, as higher volatility tends to amplify our results over a yearly horizon, even if our implied volatility surpasses the average.

During periods of increased market volatility, we acknowledge the potential for more substantial drawdowns in the initial days or weeks. However, statistically, the subsequent period following these volatility spikes provides a more favourable environment for our strategies, leading to higher returns.

This trend has manifested multiple times in recent years, notably during the March 2020 disruption caused by the onset of the COVID-19 pandemic. Despite a drawdown during that turbulent period, the remainder of the year emerged as the most prosperous phase for our strategies.

In our proactive risk management approach, we’ve implemented a “Red Flags model.” Daily, we meticulously assess the performance and statistics of our strategies, comparing them to long-term benchmarks and various internal parameters under scrutiny. Any deviation from established statistics triggers a red flag, prompting us to consider reducing allocation to that specific sub-strategy or taking appropriate actions.

Furthermore, we maintain a strict daily comparison between live returns and simulations to ensure their consistency. This verification process guarantees that our strategies perform as expected and align with our simulations consistently.

International Finance: How have you integrated AI into your day-to-day operations?

Tal Teperberg: We have long been at the forefront of the AI revolution, leveraging machine learning models, including transformers, for an extensive period. AI is not just a facet but a key element of our business operations. It elevates our analytical capabilities, refines trading strategies, optimizes monitoring processes, and fortifies our risk management practices.

The recent progress in GPT (Generative Pre-trained Transformer) technology has opened exhilarating possibilities for us. The standout feature lies in the superior Natural Language Processing (NLP) capabilities inherent in these models. This empowers us to extract richer insights from soft signals such as news feeds, financial reports, analyst calls, federal announcements, and more, significantly benefiting our strategy portfolio.

Moreover, leveraging the pattern recognition and generative completion capabilities of GPTs has enabled us to craft innovative predictive strategies. The generative output of GPTs serves as a driving force behind strategic investment decisions, adding a novel dimension to our approach.

Engaging in cutting-edge research, we actively contribute to the community effort to extend GPTs beyond their current modalities (text, images, speech, etc.) to encompass numeric time-series analysis. We firmly believe that this effort holds the potential to disrupt the field of financial prediction on a significant scale.

Lastly, like many other companies, we extensively use GPTs to enhance productivity, automate monitoring processes, and fortify our risk management practices. This multifaceted integration emphasizes our commitment to staying ahead in the rapidly evolving landscape of artificial intelligence.

International Finance: Is the fund looking for new projects and opportunities?

Tal Teperberg: We are always committed to enhancing our strategies and operations on multiple fronts. First and foremost, we prioritise building a dynamic and innovative team, seeking individuals who embody a spirit of breaking barriers and possess a blend of creativity and high computational skills. At the same time, our main objective is to elevate key performance metrics, including Sharpe and Zscore, across all our strategies. This pursuit requires a continuous exploration to integrate additional data feeds, develop unique signals with low correlation, and expand our footprint into new markets, reflecting our unending dedication to remain at the forefront of innovation in our field.