In June 2023, Saudi Arabia signed a USD 5.6 billion deal with a Chinese company to manufacture electric vehicles. The deal, signed with electric and self-driving car maker Human Horizons, has been seen as a win-win situation for both sides. Why?

The 10th Arab-China Business Conference, where the deal was signed, saw the countries trying to formulate a ‘strategic partnership’ based around the Belt and Road Initiative (BRI). As part of its ‘Vision 2030’ plan to diversify the domestic economy, Riyadh is planning to boost investments in non-oil sectors, including electric cars, a domain where Human Horizons has established its expertise.

Also, the two countries pulled off billions of dollars worth of agreements.

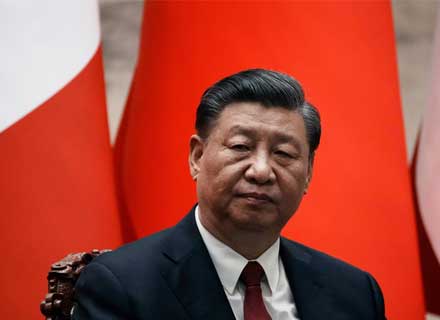

The total trade volume between the countries reached a record USD 430 billion in 2022. In December of that year, Chinese Premier Xi Jinping visited Riyadh and signed a comprehensive strategic partnership agreement. Not only that, Beijing brokered a landmark agreement between Iran and Saudi Arabia in March 2023, which led the regional rivals to re-establish diplomatic relations after a seven-year rift.

While Xi Jinping’s Gulf outreach is helping him to score diplomatic brownie points over the United States, China’s domestic economy is counter-balancing all these political developments.

Beijing Has A Problem In Its Hand Called ‘Economy’

China’s central bank has introduced a short-term policy interest rate cut, a sign that the Xi Jinping government is fretting over the faltering growth figures surrounding the world’s second-largest economy. The People’s Bank of China has lowered the seven-day reverse repurchase rate by 10 basis points to 1.9%, the first reduction since August 2022. Expect the other Chinese banks to lower their lending rates too.

China’s credit demand weakened in May 2023, with the People’s Bank of China’s ‘Aggregate financing’, a broad measure of credit, currently standing at 1.6 trillion yuan (USD 224 billion), lower than the median estimate of 1.9 trillion yuan in a Bloomberg survey of economists.

Contracted manufacturing activity, shrinking exports and a slow rebound in home sales are plaguing the world’s second-largest economy. Add the stagnated private investment in the first four months of 2023, the situation looks messier.

China’s exports fell by 7.5% from a year earlier in May 2023 and imports were down 4.5%. Factory and consumer activities have been lacklustre, along with a steady surge in the unemployment ratio.

Retail spending is going through a frustratingly slow recovery as consumers remain cautious about the future economic outlooks. A Chinese government survey in April 2023 also found that every one in five urban young workers was unemployed.

The consumer price index rose 0.2% in May 2023 from a year earlier. Core inflation slowed down to 0.6% from 0.7%. Producer prices declined 4.6% in May 2023, compared with a 3.6% fall in the previous month, as commodity prices eased and demand weakened. All these data are suggesting one that the country’s economic rebound, since the withdrawal of Xi Jinping’s much controversial ‘Zero COVID’ policy, is cooling off now.

The business conditions in the world’s largest manufacturing ecosystem improved in May 2023 and that has been the only relief for investors amid declining trade figures.

The Debt & Housing Crises

As per a report from The Print, Xi Jinping’s brainchild, the Belt and Road Initiative (BRI), an infrastructural connectivity project that aims to connect nations and continents through mega highways, road and rail networks, may not finish on time due to the USD 23 trillion local debt crisis (confirmed by a Goldman Sachs survey) unfolding in China.

Since the 1990s, China has enabled its provincial governments to build mega infrastructure projects. These initiatives were debt-financed and revenue generation was going parallel with the growth of the Chinese real estate market. However, things changed during the 2021 property market crisis, and right now these big-ticket projects have become sources of unsustainable debt.

The city of Hegang, a remote Chinese coal town, was forced to undergo financial restructuring after 2020 and currently has a debt of more than double its fiscal income. Guizhou reportedly needs a debt bailout from Beijing. Wuhan, the city which saw the debut of COVID-19 in 2019, has once again hit the headlines for its administration publicly demanding hundreds of local companies to repay their outstanding debts, combining over 100 million yuan (USD 14 million).

As per another section of analysts, China’s outstanding government debts might have surpassed 123 trillion yuan (USD 18 trillion) in 2022, with nearly USD 10 trillion classified as ‘hidden debt’ owed by risky local government financing platforms.

‘Hidden Debt’ defines the borrowing not included in the government’s on-budget debt but carries a promise of being repaid with fiscal funds or is supported by illegal guarantees. The process involves issuing bonds by state-owned businesses, created to finance local government investments.

Add the slow (or better to say no) recovery of the Chinese real estate market, after the 2021 crisis.

“We see persistent weaknesses in the property sector, mainly related to lower-tier cities and private developer financing, and believe there appears no quick fix for them,” Goldman Sachs stated, while predicting a ‘L-shaped recovery’ for the Chinese real estate industry, a stage where a sector undergoes steep declines and subsequent slow recoveries.

New home sales for the week ended May 28 grew by 11.8% from 2022, a sharp slowdown from 24.8% growth a week earlier, pointed out Nomura’s chief China economist Ting Lu in a report, which was based on seven-day moving average data from Wind Information.

The current sales volume is much lower than during the same period in 2019, the report said.

Immediately after the central bank’s rate cut, shares of property developers Logan Group and Country Garden jumped by 4.5% and 4% respectively. Market analysts and industry stakeholders are now expecting government stimulus and policy easing in the coming days, as the housing sector remains a key part of the Xi Jinping government’s vision of its city population reaching 75-80% by 2035, from the 2022 level of 65.2%.

The Road Ahead

China is standing at a crossroads. Its geopolitical rivalry with the United States has resulted in Washington and its allies aggressively cutting down Beijing’s access to the global technology market (including semiconductors). Also, its domestic economy is in shambles.

The Chinese economy needs immediate policy intervention. The central bank has already done its bit by announcing a rate cut to spur up business activities.

Will the Xi Jinping government take the game further and encourage policy easing and aggressive stimulus? To get the answers, we need to wait a few days more.