A new wave of neobanks have disrupted retail banking in the UK. Not only do they curate products based on consumer needs, but the structure of the business is making financial inclusion highly sustainable in the country.

According to a study by market research firm Propeller Insights nearly three-quarter of UK consumers engage in online banking, 77 percent of them are considering switching over to a neobank and only 21 percent of them might continue to visit a bank branch.

“In the UK especially, where the financial services market is quite developed, consumers are more willing to at least test banking alternatives. The culture of the UK consumer is vital to the success of new digital banks, says Koen Vanpraet, who is the CEO of PXP Financial, a complete end-to-end payments provider. To second Vanpraet’s view, Propeller Insights’ statistics showed that 65 percent of the country’s younger demographic between 18 years and 34 years use neobanks as alternate banking avenues.

As it appears, neobanks have changed the era where retail consumers traditionally preferred to visit bank branches for paperwork. “Over the past two years, we’ve seen an influx of consumers choosing neobanks or challenger banks as an alternative to traditional banks that we are all so familiar with,” Ian Wright CEO of SmallBusinessPrices.co.uk tells in a statement given to International Finance.

Perhaps the growing popularity of neobanks suggest that they are filling the digital expectations gap in the country. “They are helped by the fact that many of their consumers fall under the bracket of ‘digital natives’ — those who have grown up using technology. And their digital services go a step beyond what many of the traditional banks are offering,” says Ian Bradbury, CTO for Financial Services, Fujitsu UK, in an email interview with International Finance.

A study conducted by Finder on digital banking in the UK on how people might perceive banking in the future, found over one in 10 Brits have fully switched over to a neobank and 47 percent of them keep less than £1,000 in a neobank. Also, two-thirds of consumers have expressed interest to fully adopt neo banking services in the future. Certainly, the numbers highlight that neobanks are doing things differently. “They have agile ways of working, relatively cheap, stable to run and equipped with the latest technology,” Bradbury says.

Digital innovation: The hallmark of digital banks in the UK

Last year The Forrester Banking Wave: UK Mobile Apps, Q3 2019 report reviewed four traditional banks and three neobanks, which attest to Bradbury’s view. The report found that neobanks are competing with traditional banks on the back of intuitive services and retail consumers are experiencing a paradigm shift in the country’s financial landscape.

The first approach that neobanks have taken is to determine what financial tools and services consumers actually need, and then to find more meaningful ways to deliver on the potential. For example, Monzo, Revolut and Starling are making an impact on older consumers and those left vulnerable by bank branches closing down in the country. Starling and Monzo have partnered with the Post Office and PayPoint respectively to allow consumers to deposit cash in person. Here the idea is to equally serve those who find it cumbersome to use digital technology. Revolut has launched a Plain English customer contract to ease the signing up process.

For businesses, Amaiz is targeting sole traders and small business owners underserved by the banking industry. “Our research shows that this group has particular needs and we want to focus on that,” Steve Taklalsingh, managing director of Amaiz tells International Finance.

While traditional banks are busy carrying big trading assets on their books, neobanks have become more consumer-centric across demographics and are fixated on technology innovation. “Ultimately, digital innovation will be crucial in an increasingly competitive market and neobanks will have to stay ahead of their rivals on this front,” Bradbury says. “So their overall success lies on how well they can innovate — and those who attract the most consumers are those who can differentiate their products in the most creative ways.”

Simplicity and transparency is what these neobanks have been tapping into in the last two years. Amaiz has developed a mobile banking app that provides a 24/7 phone service — a unique selling point in the market today. The app uses smart analytics to manage and track all payments. “We do that because our customers are not typically people who sit in front of a computer all day. They are serving their customers — and therefore, are more likely to want to talk to someone,” Taklalsingh says. “We’ve integrated voice recognition software for top level security and to give our customers the best experience.” Neobanks integrating human touch into their sophisticated digital services have an important stronghold that is missing from much of the traditional banks’ offerings.

Gen Z wants speed and convenience

But what might seem like a quick win for startups is often a lot more to do with hype than substance, Vanpraet explains. The continuous and often advanced neo banking services are changing the traditional understanding of retail banking, but they have a long way to go. “This comes down to the majority of customers who are still sticking with traditional banks. When a new digital bank is introduced, those interested in the industry may look at what they offer and switch services if they think it is beneficial, but the vast majority of ‘casuals’ will stick with what they know.”

PXP Financial carried out a research on Gen Z payment habits in the high street and their top requirement was convenience. Today, customer experience necessitates transaction methods that are the most convenient and fastest. The research highlights that personal data security is of utmost importance for UK consumers. “Despite challengers providing a speedy and slick user experience through digital apps, many consumers still do not feel they are secure,” Bradbury says. This observation is compatible with statistics showing that 40 percent of UK consumers don’t trust neobanks to keep their data safe, and a further 49 percent plan to bank only with a traditional bank unless neobanks can demonstrate they have the right technology to protect them.

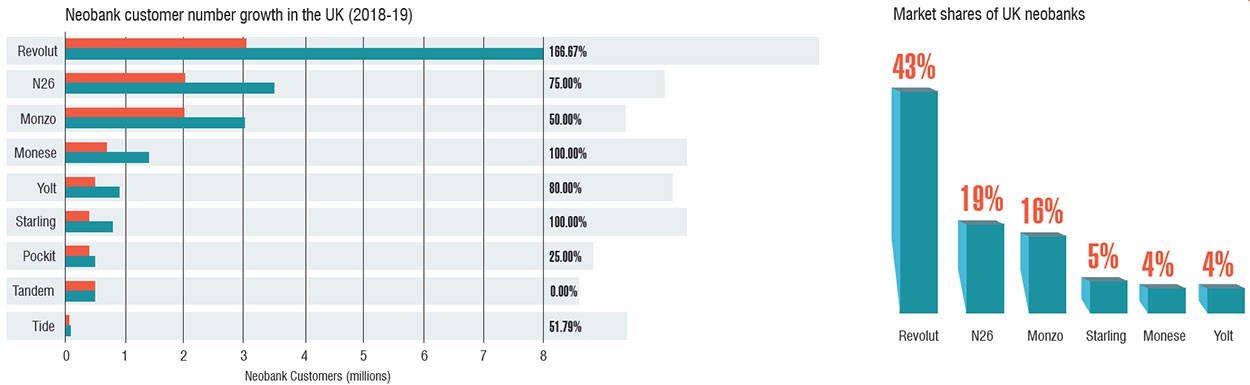

This point is debatable. Globalwebindex’s survey last year found that neobanks are more likely to be used by the country’s top income groups. The UK consumers who have used at least one service of Monzo, Starling, Revolut or Atom increased by 83 percent — an impressive growth rate since the third quarter of 2018.

Together, the neobanks in the country are expected to triple customer count to 35 million over the next 12 months, compared to 12 million users last September, according to an Accenture report. In the first half of 2019, five million consumers opened an account with them — resulting in percentage gains in primary account holders. The average account balances increased five-fold to $422 in the first half, from $84, the report noted.

Arguably, this trend could work against traditional banks if they are too slow in rendering advanced digital services. In fact, Vanpraet points out that “change can be slower for traditional banks.” The past two years have seen neobanks demonstrate robust financial performance broadening the competitive playing field of banking in the UK.

Neobanks create significant cost advantage with the average operating cost per customer ranging between £20 and £50, compared to over £170 with a traditional bank.

Performance analysis of top neobanks in the UK

Last year Monzo surpassed 2 million total users — and is expected to add 200,000 new accounts every month, compared to 60,000 a month in the previous year. Monzo crossed £40 million of annual run-rate revenue last May.

Another top neobank Starling aims to break-even by 2020 — targeting 6.7 percent share of the UK SME banking market in the next five years. Since November 2018, it has seen a rise of 110 percent in customer numbers and 200 percent in deposit base.

Revolut, one of the world’s biggest fintech unicorns, was valued at £1.3 billion last year. In 2018, it recorded £58.2 million revenue and cost of sales grew at 247 percent, improving the gross profit margin. Recently, it raised $500 million in a series D funding with a $5.5 billion valuation — and has set an ambitious goal to onboard 100 million customers in the next five years.

Revolut’s global expansion testifies the success of neobanks business model designed to take on big players in the industry, Bradbury says. “But they have a challenging future ahead of them — and it’s certainly an interesting space to watch.”

Neobanks are fighting layers of complexities

Despite the numbers, their market share is low as they are relatively new. Consumers still require their banks to have a physical presence. In fact, 56 percent of consumers show concerns over bank branches closing down in the next five years, says Bradbury, reinstating that neobanks are under strain to build trust and value.

The challenges for neobanks are not subtle. Many of them struggle to churn revenue from existing customers who are used to free services. Following that is their greatest test to prove to investors their ability to make profits — or they might not reach the level of funding received by traditional banks, Bradbury says.

Traditional banks versus neobanks: Threat or hype?

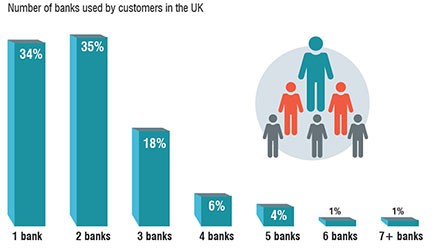

The creation of neobanks has the potential to challenge traditional banks, but for now, “they are still being seen as an add-on service, rather than a primary service,” Vanpraet says. It is impossible to turn a blind eye to the credibility and trust that traditional banks have established over the years. This should be worrying for neobanks, says Vanpraet, pointing to the fact that they are often used for smaller, less important payments. However, “neobanks proving themselves over a sustained period of time will lead to consumer trust on par with traditional banks,” Bradbury says.

The allure of going digital has increased among UK traditional banks. “As neobanks become more popular, traditional banks will hit back,” Bradbury explains. And the big news is “traditional banks already see neobanks as competitors, and this competition will only grow as more UK consumers start to use them as their main current accounts,” he adds.