The Hungarian government is on an interesting spree to increase the installed photovoltaic capacities by sixfold between 2020 and 2030. By this time, the country has faced enough pressure to develop a clear plan for its electricity generation mix over a fleet of ageing coal-fired power plants and a nuclear power plant. In 2018, the European Union’s skyrocketing prices in the emissions trading system forced the government to hold discussions with the country’s last big ignite power plant Mátra about phasing out coal and installing renewable energy.

Mátra’s lignite accounted for 16 percent of the country’s carbon dioxide emissions in 2016 and half of the energy sector’s pollution. A big chunk of the country’s coal and ignite basins have been closed and the number of miners has significantly reduced from 125,000 in 1965. The increasing frequency of climate change impacts had urged the European Union to triple the cost of a pollution permit in a year. In the same year, it was reported that the carbon price around €18 a tonne gave gas plants a competitive advantage over coal plants. The prices were anticipated to continue rising over the next five years from then, forcing a strong transition away from coal. Hungary is not as highly reliant on coal as some of its central and European counterparts like Poland, the Czech Republic and Bulgaria which have the highest percentage of coal plants, but the country has shown resistance to measures that could drive out the wicked fossil fuels.

The European Union carbon prices were anticipated to continue growing by an average of €35 to €40 per tonne over the period between 2019 and 2023. The country’s second national climate strategy that was approved by the parliament in October 2018 thoroughly supports three essential factors: reduce carbon emissions by replacing fossil fuels with clean energy; improve energy efficiency and develop a green economy through forestation. There was a common forecast around that time that coal-fired power plants in the country could sharply decline by 2025.

A report published by the University of Cambridge observes that energy efficiency interventions in buildings could result in greater benefits to climate targets. In Europe, buildings are responsible for 40 percent of final energy consumption and 36 percent of carbon dioxide emissions. The building sector in seven of the EU member states accounts for the lion’s share of total energy use than the European average. It has already reached 50 percent in Hungary, Estonia and Latvia and they could bring much bigger benefits than anywhere in Europe.

The combined impact of all these factors has now laid the foundation for Hungary to make its way into a booming solar business. The country’s efforts in investing in photovoltaics to meet the European climate targets is gradually getting off the ground and the market is a window of opportunity for foreign investors. It has been stipulated that the ratio of renewable energy resources must reach 30 percent by 2030 following the Paris Climate Agreement.

In truth, the country’s solar market is its biggest source of renewable strength as hydroelectric power stations are not a realistic option over its insufficient topographical relief and wind energy is not much of a viable option, especially with the Orbán government’s ban on the construction of wind turbines within a 12 km radius of populated areas. So this makes its solar market a huge electricity hog. The solar energy produced in the country is about an average of 1250 kWh/m2 per year compared to central France. The country has finally realised this potential enough to make investment plans in the construction of solar energy parks in the next decade, although the growth prospects are not entirely clear. The Hungarian National Energy and Climate Plan have made a forecast for the foreseeable future where the solar trend will increase from 700 MW in 2019 to 6645 MW by 2030.

After much thought, the country’s potential tenfold increase of the solar market is an especially iconic growth trend because of its slow action in phasing out coal-fired plants and scarcity of available funding limits linked to the high price of equipment.

Hungary to ditch coal by 2030

Hungary was one of the EU’s most coal-dependent member states, however, with the EU raising prices of lignite as a way of reducing greenhouse gases, Hungary is shifting its focus to renewables as its principal power source. The Hungarian government believes that a predicted price drop of up to 30 percent in photovoltaics gives the country the chance to meet the energy directives proposed by the EU, which states that all 28 members within the bloc must source 20 percent of their energy from renewable sources by 2020.

President Janos Ader said on September 24 at the UN Climate Action Summit in New York that Hungary will increase its solar power capacity ten times by 2030. It will stop producing energy from coal while expanding the production of nuclear power plants. He said, “Thanks to the combined effect of these three measures, 90 percent of Hungary’s electricity production will be carbon-free by 2030 and not by 2050. We will also improve the energy efficiency of our buildings by at least 30 percent by 2050. And, by 2030, we will use only electric buses in our cities.”

However, this has pushed the mining communities into a state of apprehension when it comes to their future. Many believe Hungary wants to emulate Spain in this regard. Spain also announced that it will aim to derive 100 percent of its energy needs from renewable energy sources by 2050. To achieve such a feat, the Spanish government has come up with a transition plan worth €250 million. As per the plan, the country is planning for a transition of workers in the coal industry to clean energy jobs by providing them with the right kind of training and requisite skills.

Currently, Hungary has 2000 MW of PVs installed in the country. However, it aims to increase this to 30,000 MW by 2022 in its renewable drive. This makes Hungary an attractive proposition for solar investors seeking to invest in the CEE region. With Hungary taking its commitments to renewable energy increasingly seriously, the pivot is set to be closely observed by investors.

Hungary’s energy mix

Hungarian energy supply is dominated by imports from Russia. Hungary imports around 80 percent of its gas requirements from the Russian majority state-owned multinational energy corporation Gazprom. As both domestic gas and oil production has peaked, many believe that imports will only increase from here on. However, exploring the renewable energy potential could help counter that.

The Paks Nuclear Power Plant, located 5 kilometres from the small town of Paks in central Hungary contributes significantly to Hungary’s electricity grid. It is the first and only operating nuclear power station in Hungary and it supplies approximately one-third of the country’s power. Coal remains the second biggest contributor to Hungary’s energy mix after nuclear power, accounting for 21 percent in 2014, down from 17 percent in 2010.

Nuclear power accounted for 49 percent of domestic electricity generation in 2019 in Hungary. Meanwhile, gas contributed to 23 percent of the total electricity generation, coal 15 percent and renewables 12 percent. While nuclear is expected to continue to be the primary source of energy, renewable is expected to grow in Hungary in the coming years. According to Enerdata.net, half of the gas in Hungary is consumed by households and services. The share of industry in gas consumption has increased since 2000, from 18 percent to 22 percent in 2019 (including non-energy uses), a share higher than that of the power sector (19 percent).

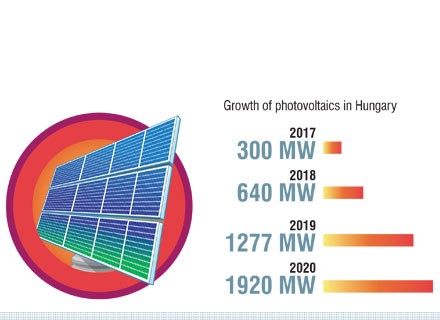

Hungary proposes a share of 20 percent energy from renewable sources in the gross final consumption of energy in 2030 and corresponding sectoral shares. In 2015, 10.5 percent of the gross Hungarian electricity production came from renewables, whereas around 52 percent of that amount was from biomass. Wind energy stood at 22 percent was from wind, 7 percent was from hydro-energy and solar contributed to only 3 percent of the total. However, the solar power landscape in Hungary is expected to change. While, by the end of 2015 Hungary had installed more than 110 MW of photovoltaics, by the end of 2019, Hungary had installed more than 1277 MW of photovoltaics. By the end of the third quarter of 2020, the installed solar power capacity was 1920 MW.

Hungary to reach 6 GW of solar capacity by 2030

Currently, Hungary has a solar power capacity of 2 GW, however, according to László Palkovics, Minister of Innovation and Technology in Csorna, northwestern Hungary, the government aims to achieve a three-fold increase by 2030. According to the minister, the spectacular growth of solar power generation in Hungary is attributed to the installations of solar panels on rooftops, which has led to the growth in the household solar sector. To support the growth, the Hungarian government is planning to provide non-refundable subsidies this year.

Due to its geographical position, Hungary has a large potential for solar power generation. Compared to other parts of Europe, Hungary’s average solar radiation is over 1300 KWH/m². The good news for Hungary is only a very small part of this is being tapped into. It was reported that there is a tender for more than 2 GW of capacity. Looking at the current scenario and the government’s commitment towards renewables, we can expect much more growth especially in household and small size power generation.

What Hungary wants to do is to increase the rate of carbon-free electricity production to almost 90 percent by 2030. This will be achieved by increasing activities in nuclear and solar power in the country. The minister further added that scaling up production capacity in the solar sector is also important from the aspect of industrial policy. According to him, the European countries could reach a level where they could compete with Asian countries that dominate this segment. However, to be competitive enough the European countries need new technological advancement, production of renewable energy equipment and also enough funding. Giving the example of the Ecosolifer plant, the minister said that similar projects could help Europe to reposition itself in the global market.

Over the years, many solar projects have been sanctioned in Hungary. The Ecosolifer plant was developed with a total investment was €53 million. Around €6 million of the funds came from the Hungarian government. According to its COO, Rikus Janken, the capacity of the plant may be further raised to 300 MW at a later stage.

China National Machinery Import and Export (CMC) is building central Europe’s largest solar plant in Hungary, worth €100 million. The project will support the country’s climate policy targets, including making Hungary a country that can produce energy in a carbon-neutral way by 2050.

László Palkovics, Hungary’s innovation and technology minister told the media, “The solar park will contribute to developing a well-balanced and sustainable energy mix in Hungary and guaranteeing the country’s energy security. Hungary is sometimes classified as a climate change-sceptical country, but if we look at the Hungarian people and the performance of the Hungarian economy in terms of sustainability, we have no reason to be ashamed. Hungary has reduced its carbon dioxide emissions by 32 percent since 1990, achieving the 40 percent reduction target for 2030.”

Last year, media houses also reported the completion of a 20 MW photovoltaic power plant at the town of Felsozsolca in Northern Hungary. The newly installed plant now delivers clean energy to around 8000 homes. Similarly, Hungarian state-owned utility MVM is planning to expand its solar photovoltaic (PV) footprint in the country to about 1GW. Earlier in August, its renewable subsidiary MVM Zold Generacio closed a tender for new solar PV units of 0.3 to 60MW each, with a combined capacity of 300MW.

Under Hungary’s National Energy Strategy up until 2030, the country plans to ensure the long-term security of energy supplies and increasing the share of renewable sources such as solar in its energy mix. The strategy also points out the importance of fossil fuels for future generations. Besides boosting renewable energy capacity, the central European country also plans to boost its nuclear energy capabilities as well. The National Energy Strategy further notes that the construction of new power plants will be required to replace those that will become obsolete in the future.

Investor’s optimistic about Hungary’s solar market

In the Renewable Market Watch’s yearly updated ‘Attractiveness index for solar photovoltaic (PV) energy investments in CEE and SEE countries in 2020, Hungary is ranked among the top 10 countries when it comes to attractiveness for solar photovoltaic (PV) energy investments. The very fact that Hungary is focused to meet the growing need for power in the country through renewables and reduce its carbon footprints makes the country an investment hotspot. Notably, Hungary is also one of Europe’s biggest coal consumers. Hungary plans to increase solar panels to 30,000 MW by 2022, making the country a magnet for solar investors.

Budapest’s current solar power capacity is around 500 MW and the capital city wants to boost it to 3,000 MW by 2022. The country plans to replace coal with alternatives such as nuclear and renewables. Another factor that makes Hungary a hotspot for renewable investment is the fact that the number of sunny hours in Hungary is between 1,950 and 2,150 per year. If the potential is tapped into, the country could generate a huge amount of energy which could equal several tens of thousands of MW. Investors across the globe understand Hungary’s potential and as authorities sanction projects in the future in this regard, we could see a rush from green investors to put their money in renewable projects in Hungary.